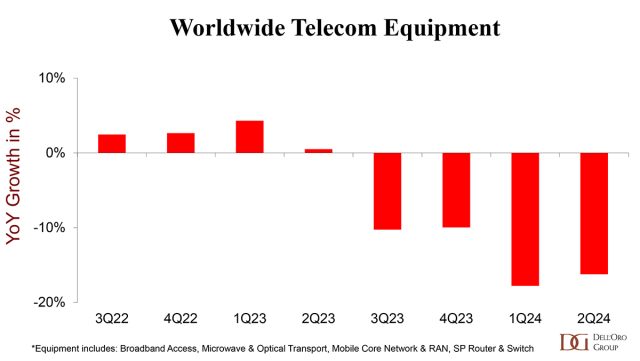

Dell’Oro Group forecasts global telecom equipment revenue will drop 8-10 percent in 2024, down from the 4 percent decline in 2023.

The development reflects a report from MTN Consulting that said telecom operator Capex will drop to $295 billion – $305 billion in 2024 from $315 billion in 2023.

Worldwide telecom equipment revenues fell 16 percent in the second quarter of 2024, recording a fourth consecutive quarter of double-digit contractions, a report from Dell’Oro Group said.

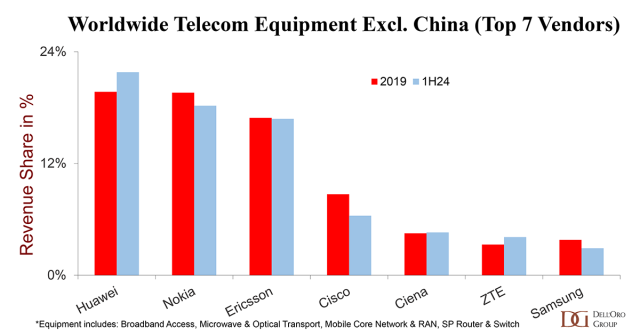

Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung are the top 7 telecom equipment suppliers in 1H24. They accounted for 80 percent of the worldwide telecom equipment market.

Huawei and ZTE combined gained nearly 3 percentage points of share between 2023 and 1H24.

MAJOR SUPPLIERS

Sales of Ericsson dropped 7 percent to SEK 59.848 billion or $5.89 billion in Q2 2024. Revenue of Ericsson also includes its sales from enterprise business.

Nokia’s revenue fell 18 percent for the second quarter of 2024 to €4.47 billion or $4.81 billion. Revenue of Nokia includes its sales from enterprise business.

Ciena’s revenue dropped 19.6 percent to $910.8 million for the second quarter of fiscal 2024.

Samsung’s revenue from eXperience (DX) for Q2 2024 surged 23.4 percent to 74.07 trillion Korean won or $53.45 billion. Samsung DX division includes Mobile eXperience (MX) / Networks (NX) and Visual display (VD) / DA. Samsung does not reveal the size of its revenue from mobile network business.

ZTE’s revenue from operator network was RMB 37.30 billion in the first-half of 2024.

Huawei’s revenue rose 34.3 percent to RMB 417.5 billion in the first-half of 2024. Huawei is yet to reveal the size of its revenue from operator network business.

Cisco’s revenue fell 6 percent to $53.8 billion for fiscal year 2024. Cisco does not reveal the size of its revenue from operator network business.

Telecom equipment includes broadband access, microwave & optical transport, mobile core network (MCN), radio access network (RAN), and SP router & switch. All six telecom equipment segments declined in the second quarter. Spending on SP Routers fell by a third in 2Q24.

There was slower revenue growth in all regions, including North America, EMEA, Asia Pacific, and CALA (Caribbean and Latin America). Telecom equipment market in China declined 17 percent.

Baburajan Kizhakedath