Nokia has announced its open and programmable fixed access network slicing solution – built on its cloud-native software platform Altiplano and open standards — for telecom operators.

The advanced fixed access network slicing solution from Nokia delivers more than service level slicing. The solution enables telecom engineers at mobile operators to scale to unlimited number of discrete network slices that can be independently operated.

Nokia said the Altiplano software platform allows mobile operators to establish full control and autonomy for each slice they manage, plus determine the performance metrics for the network and services they deliver to customers.

Nokia’s programmable slicing solution uses open interfaces and YANG data models to create a virtual slice that operates like a physical network. Service providers run their own dedicated controller with a dedicated view of their slice of the network – for control and flexibility to deliver differentiated broadband services in a multi-vendor network environment.

Nokia’s Fixed Network Slicing solution can help services providers move toward a fully autonomous Network as a Service (NaaS) model, allowing them to:

# Converge internal organizations and attract co-investment partners to improve capital efficiency and accelerate time-to-market.

# Quickly develop new strategies and create service offerings that better monetize their access networks.

# Enter a new business area, such as vertical markets and enterprise services, which can be served from the same access infrastructure as residential customers

# Accelerate 5G deployments by configuring a slice to meet the SLA requirements for 5G anyhaul, negating the need for a dedicated backhaul/fronthaul network.

# Optimize multi-operator vectoring for G.fast deployments in a fiber-to-the-building (FTTB) environment.

Nokia will be hosting a session with Vodafone on October 24 at the Broadband World Forum event in Berlin to explain the application of fixed access network slicing.

“Virtual network slicing can provide a more elegant and powerful way to monetize ultra-broadband deployments, help accelerate the delivery of new services, spread investment risk, reduce complexity and unlock new business opportunities,” Federico Guillen, president of Nokia Fixed Networks, said.

Broadband investment

Broadband operators can explore innovative opportunities to monetize their access networks and get more partners, stakeholders and communities to strengthen the business case for large scale FTTH / FTTB roll-outs.

Network as a Service (NaaS) creates new business opportunities for digital service providers to improve services to end-customers and helps to deliver more services to more end points in the most economical way, according to a Nokia whitepaper.

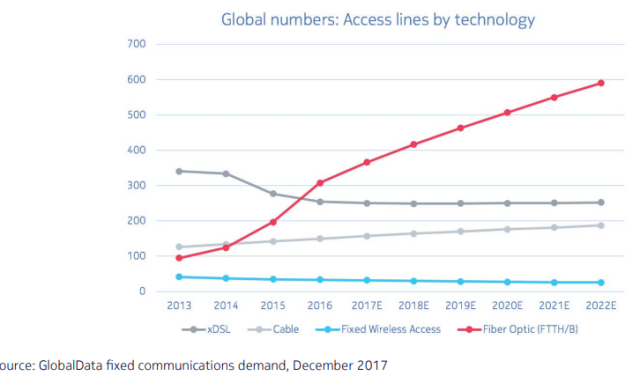

FTTH, the costly broadband technology, requires significant capital expenditures (Capex) and operational costs (Opex) and these investments put a strain on the access-centric network operator. Passive infrastructure can account for almost 80 percent of the investment for rolling out broadband.

Opening the fixed broadband network to additional service providers can be a very attractive way of sharing the cost and risk. Multiple parallel networks covering the same area can be difficult to justify commercially due to low take-up rates and long-term ROI.

Nokia said sharing network infrastructure can reduce investment and subscriber acquisition costs. The upfront costs of fiber are justifiable as telecom operators succeed in delivering above-average EBITDA margins.

Without 25 percent share of the market, fixed operators are not likely to achieve the EBITDA margins needed for capital returns above the weighted cost of capital.