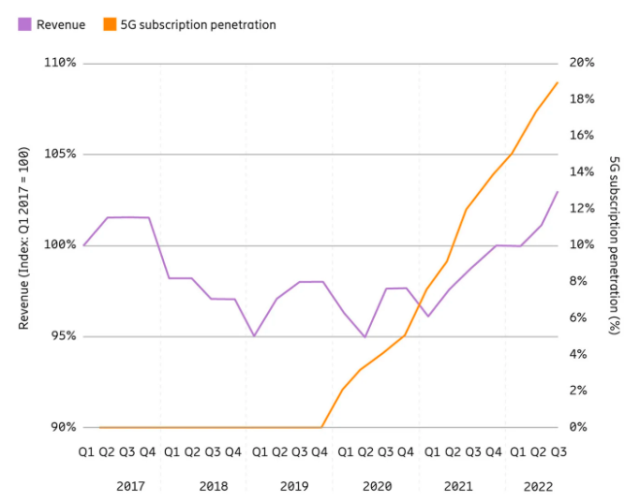

Mobile opeators in the top 20 5G markets have achieved a positive revenue growth since the beginning of 2020 that correlates well with the increasing 5G subscription penetration, according to Ericsson Mobility Report Business Review edition.

The latest Ericsson report said there has been a positive growth trend in the top 20 5G markets since Q1 2020, which correlates with increased levels of 5G subscription penetration. Average revenue growth over the past 2 years has been 6.5 percent, or 3.2 percent annually.

All of the top 20 5G markets have 5G penetration of more than 15 percent, with average penetration of above 20 percent. The most mature market reaches a 5G subscription penetration close to 40 percent compared to the global average of around 10 percent.

In the top 20 5G markets, the average downlink throughput has increased by 4.3 times over the past 5 years. This is 32 percent more than other markets on a global level, showing the positive impact 5G has had on network performance and user experience. The most significant network performance improvement in the top 20 5G markets happened in 2020, following the introduction of 5G services.

In the top 20 5G markets, the downlink speed of 5G is 5.8 times higher than the speed of 4G (187 Mbps vs. 32 Mbps) in Q3 2022. This performance boost is what service providers could offer to consumers as an immediate benefit of upgrading to 5G.

The top 20 5G markets have twice the 5G penetration compared to the global market average, as well as almost 6 times better performance of 5G in these networks.

A number of service providers are exploring speed tiering as a way to monetize the significant performance boost offered by 5G. This allows 5G performance to be offered as a “ladder”, enabling an incremental upgrade path for consumers, while also creating a gradual monetization model for service providers. Incremental pricing models are key for service providers, both for effectively addressing the individual needs of each customer and for continuing to drive long-term revenue growth.

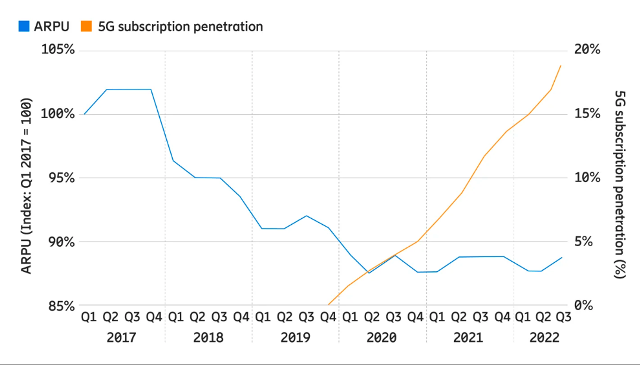

An examination of how service providers convert their business propositions into business results reveals that revenue curves are again pointing upwards, after a period of slow or no growth. While network investments have been substantial in the initial phase of 5G, with yearly capex levels of the top 20 5G markets increasing by around 30 percent between 2017 and 2022, there are now signs of positive returns on those investments.