Graphics chip designer Nvidia forecast a sharp drop in revenue in the current quarter on the back of a weak gaming industry.

Nvidia said it expected third quarter revenue of $5.90 billion, down 17 percent on year, but said the declines would be partially offset by growth in the data center and automotive business.

Nvidia said it expected third quarter revenue of $5.90 billion, down 17 percent on year, but said the declines would be partially offset by growth in the data center and automotive business.

“We are navigating our supply chain transitions in a challenging macro environment and we will get through this,” Nvidia CEO Jensen Huang said in an earnings statement.

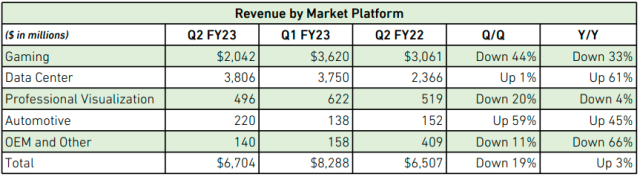

Nvidia reported second quarter revenue of $6.7 billion which was significantly lower than the $8.1 billion Nvidia forecast in May.

Nvidia’s second-quarter revenue from Professional Visualization fell 4 percent to $496 million.

Nvidia’s second-quarter revenue from Automotive business rose 45 percent to $220 million.

These increases were driven by revenue from self-driving and AI cockpit solutions, partially offset by a decline of legacy cockpit revenue.

These increases were driven by revenue from self-driving and AI cockpit solutions, partially offset by a decline of legacy cockpit revenue.

Nvidia’s data center revenue increased 61 percent to $3.81 billion.

The increase was primarily driven by hyperscale customer revenue, which nearly doubled. Sequentially, sales to North America hyperscale and cloud computing customers increased. There was lower sales to China hyperscale customers. Key workloads driving growth included natural language processing, deep recommenders, autonomous vehicle fleet data processing and training, and cloud graphics.

Nvidia said its gaming division posted 33 percent drop in revenue to $2.04 billion.

These decreases were primarily due to lower sell-in of Gaming products, reflecting reduced channel partner sales due to macroeconomic headwinds. In addition to reducing sell-in, it implemented pricing programs with channel partners to address challenging market conditions that are expected to persist into the third quarter.

The gaming industry has been showing signs of weakness as consumers pull back from discretionary purchases such as video-gaming gear amid decades-high inflation.

Chipmakers have also been struggling with supply-chain snarls ahead of the key holiday period due to the Russia-Ukraine conflict and COVID-19 curbs in China’s manufacturing hubs.