Kimi Lin and a team of analysts at Omdia have published a report on the growth potential of the near-eye display market.

Growth in the near-eye display business will be powered by the innovation spearheaded by stakeholders in the XR industry for their fans for AR, VR and MR headsets. This article has covered observations made by analysts at IDC and Omdia on the recent developments in the XR industry.

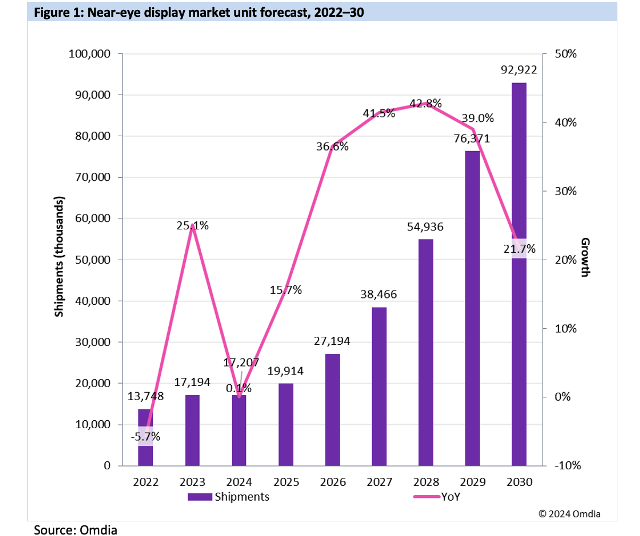

Despite a projected stagnation in near-eye display shipments for 2024, the long-term outlook for the market remains positive, Kimi Lin said in a recent Omdia report.

“With advancements in display, optical, and other component technologies, Omdia is optimistic about the long-term outlook. Near-eye display shipments are projected to grow rapidly from 2027, reaching 92.9 million units by 2030,” stated Kimi Lin, Senior Research Analyst at Omdia.

The global display industry is set to convene at the Omdia Display Conference from September 12-13, 2024, in Shanghai, China. During the event, Kimi Lin and a team of Omdia analysts will present their research on the latest innovations within the display sector.

XR market

The XR market, which includes AR, VR, and MR, is currently facing a downturn, causing significant layoffs at leading companies and prompting several smartphone brands to halt or scale back their XR projects. Despite these setbacks, industry leaders are determined to rejuvenate the market and drive growth in the coming years, Omdia said.

For instance, Microsoft announced layoffs primarily targeting its mixed reality (MR unit, responsible for the HoloLens 2 AR headset.

Technology major Google is cutting hundreds of jobs in its AR (Augmented Reality) hardware and voice assistant businesses, according to reports.

Another tech giant Meta Platforms, which owns Facebook, Instagram and WhatsApp, has announced plans to cut 10,000 jobs in 2023.

China-based ByteDance-owned virtual reality (VR) headset maker Pico is conducting a new round of job cuts in line with a restructuring.

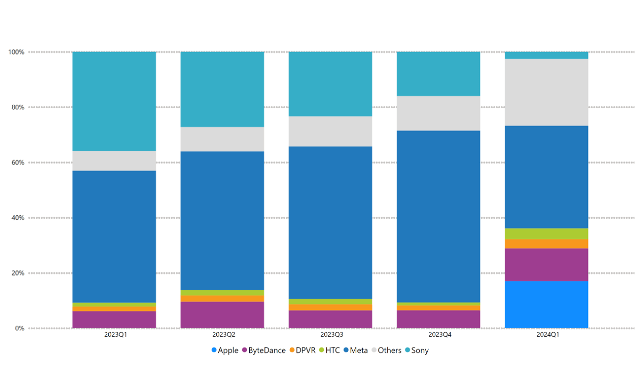

The latest IDC report said global shipments of augmented reality and virtual reality (AR VR) headsets fell 67.4 percent in the first quarter of 2024 as the market is transitioning to include new categories such as Mixed Reality (MR) and Extended Reality (ER).

The average selling price (ASP) of AR and VR headsets rose to over $1000 as Apple entered the market and incumbents such as Meta focused on premium headsets such as the Quest 3.

Virtual Reality headsets are forecast to reach 24.7 million units by the end of 2028, representing a five-year compound annual growth rate (CAGR) of 29.2 percent as the consumer base slowly grows beyond core gaming use cases and as businesses adopt more headsets for training, design, and more.

Augmented Reality headsets will grow from a smaller base of less than a million units in 2024 to 10.9 million in 2028, representing an 87.1 percent CAGR over the same period, Jitesh Ubrani, research manager, Mobility and Consumer Device Trackers at IDC, said.

Growth plans

Meta and PICO plan to launch the Quest 3S and PICO 4S in the second half of 2024, both at lower prices than their predecessors to stimulate sales. Meanwhile, Sony’s PlayStation VR2 (PS VR2) will now support PC VR games, expanding beyond its previous PS5 exclusivity, which is anticipated to boost PS VR2 sales, Omdia said.

Additionally, Meta Platforms has announced the initial release of its XR operating systems to third-party OEMs, including ASUS, Lenovo, and Microsoft Xbox. Meta will also focus on enhancing the quality and quantity of its platform and application software to improve hardware terminal sales.

In 2024, the XR market’s primary focus will be on the Apple Vision Pro. Its high price is expected to limit its sales, preventing it from significantly boosting overall market growth.

Omdia predicts that total XR set shipments in 2024 will remain steady compared to 2023, with near-eye display shipments also flat at 17.2 million units. Nonetheless, the Vision Pro has significantly increased the share of OLED on silicon (OLEDoS) displays.

The XR industry is expected to remain stagnant for the next one to two years. While set shipments will experience slight fluctuations, near-eye display shipments are projected to increase more significantly due to the inevitable shift from single to dual displays.

Baburajan Kizhakedath