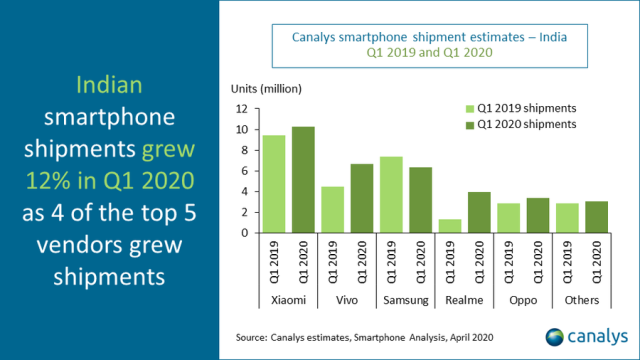

Vivo has overtaken Samsung for the first time to take second place, while Xiaomi achieved a market share of 30.6 percent in India’s smartphone market in Q1 2020.

India’s smartphone market increased 12 percent to 33.5 million units, despite the impact of a nationwide lockdown in the final week of March due to the spread of coronavirus that was first reported in China.

India’s smartphone market increased 12 percent to 33.5 million units, despite the impact of a nationwide lockdown in the final week of March due to the spread of coronavirus that was first reported in China.

Xiaomi, the #1 smartphone supplier, shipped 10.3 million smartphones in the first quarter. Vivo grew smartphone shipments by close to 50 percent by shipping 6.7 million, grabbing share of just below 20 percent.

Samsung fell 14 percent to third place with 6.3 million units shipped.

Realme maintained fourth place with 3.9 million units.

Oppo finished fifth with 3.5 million units.

Xiaomi’s investments in local production and supply chain, coupled with an efficient online and offline channel strategy are its strengths, said Canalys Analyst Madhumita Chaudhary in a statement.

Canalys expects smartphone shipments in India to plunge in Q2 2020, as the lockdown remains in force up to May 3 and vendors grapple with both supply- and demand-side issues in the immediate future.

Research firm Counterpoint said India’s smartphone shipments grew 4 percent to over 31 Million units in Q1 2020. January and February shipments grew due to new launches and promotions. 19 percent decline in March due to COVID-19 outbreak restricted overall quarter growth to 4 percent.

Xiaomi leads the India smartphone market with 6 percent growth driven by the strong performance of its Redmi Note 8 series. Offline expansion, customer focus, and affordable pricing strategies also helped Xiaomi to expand its consumer base.

Vivo grew 40 percent driven by strong performance Y series models. Vivo exited the quarter with low inventory which helps the brand have a good command over its market planning and new launches.

Samsung’s shipments were driven by its upgraded A and M series such as A51, A20s, A30s, and M30s. Samsung managed to hold third position due to launches across several price tiers, especially in the affordable premium segment with S10 Lite and Note 10 Lite.

Realme grew 119 percent driven by the newly launched 5i and C3. Realme was the first brand to launch a 5G-enabled phone in the India market when it introduced Realme X50 Pro 5G in the country.

OPPO shipments grew 83 percent, due to demand for its budget segment devices, A5 2020 and A5s, as well as a good performance for the recently launched A31 and A9 2020 in the offline segment.

A GST hike was announced during the quarter which will have an impact on OEMs margins and new launches. A strong dollar and the GST hike will be detrimental to the mobile phone industry. Most of the OEMs have increased smartphone prices due to the hike.