Global smartphone production has dropped 3 percent quarterly to 286 million units in 2Q24 mainly due to the inventory adjustments, TrendForce reports.

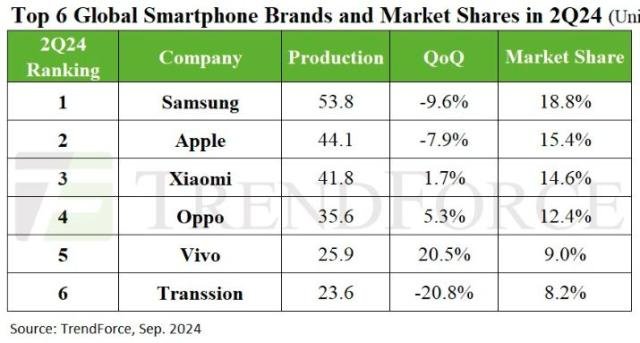

The above chart from TrendForce indicates that the smartphone production of leading brands such as Samsung (53.8 million), Apple (44.1 million), Xiaomi (41.8 million), Oppo (35.6 million), Vivo (25.9 million), and Transsion (23.6 million) during the second quarter of 2024.

Production of smartphone is forecast to achieve a modest QoQ increase to 293 million units for the third quarter. However, this still reflects an approximate 5 percent YoY decrease.

Samsung’s smartphone production fell 10 percent in the second quarter to 53.8 million units as the distribution period for the Galaxy S24 drew to a close.

Samsung is expected to unveil a premium slim foldable smartphone by the end of Q3, in addition to the Z Fold 6 series.

This slim model from Samsung is projected to represent only 1 percent of Samsung’s foldable production due to its high price point and the absence of any groundbreaking features. This new slim model from Samsung will provide only minimal assistance in boosting its smartphone market share.

Apple manufactured around 44.1 million smartphones, registering 8 percent decline from the previous quarter and 5 percent YoY increase, in the second quarter.

Apple has followed strategy of reducing prices of iPhones in China market, the largest 5G mobile phone market in the world. This may assist Apple is enhancing iPhone production in the third quarter. Apple is also set to introduce four new iPhone models on September 9. Production for these upcoming devices in 2024 projected to surpass 86 million units — registering 8 percent increase from the previous year.

Xiaomi (including Xiaomi, Redmi, and POCO) produced 41.8 million smartphones in Q2, achieving a 19 percent YoY increase. Xiaomi has set a low single-digit growth target for Q3 production due to the lack of a significant recovery in demand.

Oppo (including Oppo, OnePlus, and Realme) achieved 6 percent YoY increase in production in Q2. The Chinese market dominates Oppo’s sales at 35 percent, followed by India and Southeast Asia. Oppo’s production targets are expected to remain stable, roughly in line with Q2 levels.

Smartphone production at Vivo (including Vivo and iQoo) increased 20.5 percent QoQ and 10.2 percent YoY. Chinese market accounts for 50 percent of sales for Vivo. TrendForce says Vivo’s smartphone production in Q3 will likely remain on par with Q2.

Transsion (including TECNO, Infinix, and itel) has reduced its production to 23.6 million units in Q2 — a 20.8 percent QoQ decline. In Q3, Transsion aims to maintain its Q2 production levels to avoid inventory pressure.

Smartphone brands are generally adopting a conservative approach to their production plans for the second half of 2024 to cope with uncertain demand.

Baburajan Kizhakedath