The global smartphone market is poised for a robust recovery with 3.8 percent growth in 2024 as per the latest projections by the International Data Corporation (IDC). Anticipating a 7.3 percent year-over-year growth in the fourth quarter of 2023 (4Q23), IDC’s Worldwide Quarterly Mobile Phone Tracker highlights an optimistic trajectory for the smartphone industry.

Following a moderate improvement in the third quarter and a subsequent absence of inventory buildup, major channels and original equipment manufacturers (OEMs) are gearing up their strategies for the upcoming months, leading to an enhanced forecast for the holiday quarter.

Following a moderate improvement in the third quarter and a subsequent absence of inventory buildup, major channels and original equipment manufacturers (OEMs) are gearing up their strategies for the upcoming months, leading to an enhanced forecast for the holiday quarter.

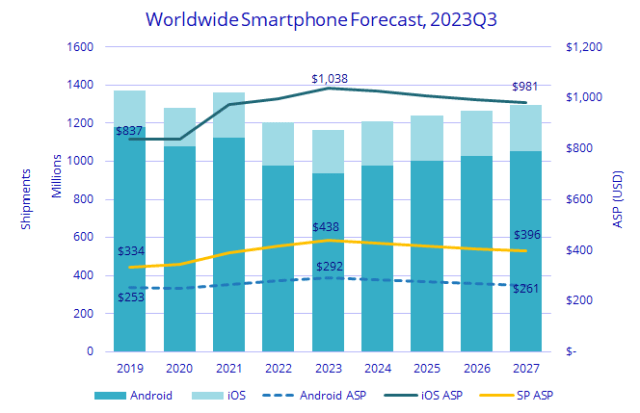

While 2023 saw an initial forecast of a 4.7 percent decline in worldwide smartphone shipments, the revised prediction now indicates a 3.5 percent decrease to 1.16 billion units, showcasing a notable improvement in expectations.

Nabila Popal, IDC’s research director, attributes this shift in sentiment, particularly in China, to consumers regaining confidence and investing in devices, driven by Huawei’s resurgence, which is expected to positively impact the broader Android market in the long term.

However, as the smartphone market heads into a phase of low single-digit growth and extended refresh cycles, a maturation trend becomes apparent. Despite shipment levels lingering below pre-pandemic figures throughout the forecast, average selling prices (ASPs) and market values are set to sustain notably higher levels than previous years.

The current trajectory indicates a steady increase in smartphone ASP, projected to grow by 5.5 percent in 2023 to reach $438, marking the fourth consecutive year of growth. Nonetheless, this growth is anticipated to stabilize and gradually decline to $396 by 2027, remaining higher than prior forecasts.

From an operating systems (OS) standpoint, iOS showcases resilience amid macro challenges, with a 0.6 percent growth, securing a record share of 19.6 percent in 2023, while Google Android is expected to experience a 4.4 percent decline. Over time, Android is foreseen to grow slightly faster than iOS, aiming for an 81.3 percent market share by the end of the forecast period.

The report also underscores the significance of 5G adoption, particularly in emerging markets, as a pivotal factor in the industry’s resurgence. While 5G smartphones witness a decreased relevance in developed markets, their growth in emerging economies is anticipated to fuel a rebound in 2024 and beyond. Global 5G shipments are estimated to escalate by 11 percent in 2023 and a further 20 percent in 2024, with the share of 5G smartphones soaring from 61 percent in 2023 to 83 percent by 2027.

Anthony Scarsella, IDC’s research director, emphasizes the stark difference in growth rates between smartphones and 5G shipments, projecting a 1.4 percent compound annual growth rate (CAGR) for smartphones from 2022-2027 compared to an impressive 11.1 percent CAGR for 5G shipments during the same period.

The smartphone market outlook for 2024, according to IDC’s forecast, presents a promising landscape characterized by technological advancements, evolving consumer behaviors, and a reshaped competitive environment that could redefine the future trajectory of the global smartphone industry.