The landscape of American television is undergoing a seismic shift as the allure of cable and satellite pay-TV services wanes in the face of the streaming revolution.

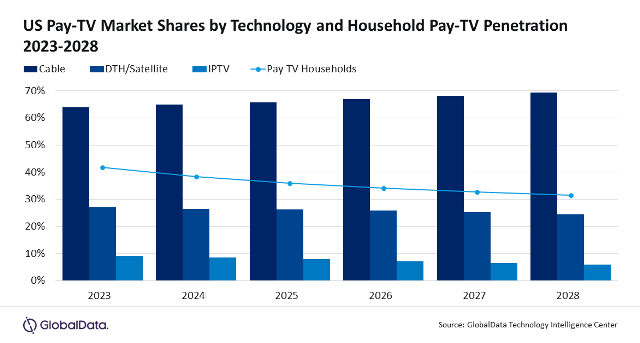

A report by GlobalData forecasts a staggering drop in pay-TV household penetration from its zenith of over 85 percent in the late 2000s to a predicted 42 percent in 2023, plunging even further to a mere 32 percent by 2028.

The report, aptly titled “United States Pay-TV Forecast,” outlines a stark future for linear pay-TV subscriptions in the US. By 2025, these subscriptions are expected to dip below 50 million, reflecting an ongoing exodus from traditional cable and satellite TV towards the burgeoning realm of streaming services.

The allure of ad-supported streaming video (AVOD), free ad-supported streaming TV (FAST) platforms, virtual multichannel video programming distributors (vMVPDs), and streaming video on demand (SVOD) services like Netflix and Amazon Prime Video has drawn viewers away from conventional pay-TV models.

This shift is led by cord-cutters — individuals abandoning traditional pay-TV subscriptions in favor of more flexible, diverse, and often more affordable streaming options — and cord-nevers, a generation of young adults who have never subscribed to cable or satellite TV.

A driving force behind this seismic change is the ‘generation rent’ phenomenon. Younger demographics, facing housing market challenges and renting for longer periods, gravitate toward entertainment options that offer flexibility without the need for physical installations, allowing easy cancellation and re-subscription.

Sports programming, long considered the bastion of traditional pay-TV services, has seen a migration toward streaming platforms. Major sports events like NFL Thursday Night Football and MLS Season Pass are now exclusive to streaming services like Amazon Prime and Apple TV+, signaling a tectonic shift in viewer behavior.

As the subscriber bases of cable and satellite providers dwindle, cable companies are poised to hold a larger share of the diminishing pay-TV market. The report suggests that cable will commandeer 69 percent of the US pay-TV market by 2028, up from 64 percent in the current year, primarily at the expense of satellite providers who face a steeper decline.

However, despite efforts by cable and satellite providers to boost revenue through price hikes, the overall pay-TV subscription revenue is on a downward trajectory. From an anticipated $80.8 billion in 2023, it’s projected to plummet to under $63.6 billion by 2028 — a concerning -5 percent CAGR decline.

The looming reality painted by this forecast underscores the imperative for traditional pay-TV services to adapt and innovate in the face of an increasingly digital landscape dominated by streaming services. As viewers continue to embrace the freedom and variety offered by OTT streaming, the future of conventional pay-TV hangs in a precarious balance.