Analysts at research firms have revealed the latest growth trends and consumer buying patterns in the smartphone display market.

Recent developments

How making investment in the display of their smartphones in important for phone vendors? Most of the customers look for display and look of their smartphones – in addition to speed or performance of the device.

Galaxy A55 5G and Galaxy A35 5G smartphones from Samsung come with Super AMOLED displays, offering better clarity in Full High Definition for watching the latest shows or browsing social media.

In 2023, Apple introduced iPhone 15 and iPhone 15 Plus featuring Super Retina XDR display that is great for watching content, streaming Apple Fitness+ workouts, and playing games.

Oppo says its Find X7 Ultra’s display places a firm focus on quality and eye comfort, allowing it to be used for longer while minimizing potential eye strain. Find X7 Ultra is the first device to achieve the DXOMARK Eye Comfort Display Label for its Gold-rated display.

Vivo said its Y28s and Y28e smartphones feature 16.6 cm (6.56-inch) High Brightness Sunlight display with a peak brightness of up to 840 nits, and a 90 Hz refresh rate. The Y28s offers an HD+LCD display. The Y28e is equipped with an HD display. Geetaj Chanana, Head of Corporate Strategy at vivo India, believes that investment in the advanced display technology make the consumer experience much more delightful.

Xiaomi 14 has advanced display technology, minimizing bezel size to 1.61mm, expanding screen size for better viewing experience.

AMOLED dominance on the rise

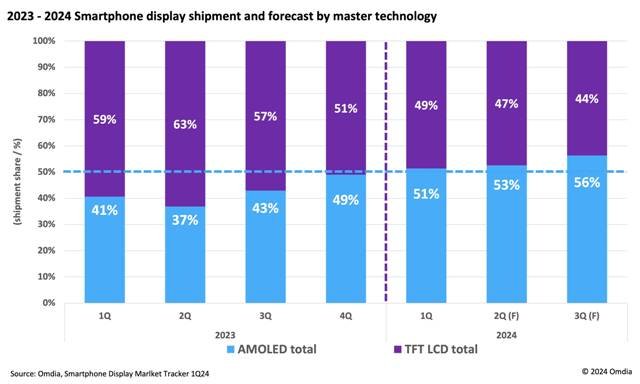

According to Omdia’s latest Smartphone Display Market Tracker, AMOLED technology is set to surpass TFT LCDs in shipments by 2024.

In 2023, annual smartphone display shipments hit 1.45 billion units, a 5 percent year-on-year increase from 2022. This upward trend is expected to persist into 2024, with projected shipments for the first half of the year reaching 715 million units, up 9 percent from 657 million units in the same period of 2023.

A significant market shift is underway as AMOLED shipments grow while TFT LCD shipments decline. In the first quarter of 2024, AMOLED shipments surged by 39 percent to 182 million units, surpassing TFT LCD shipments, which fell by 10 percent to 172 million units. This marks the first instance of AMOLED shipments exceeding TFT LCDs on a quarterly basis.

Hiroshi Hayase, Research Manager at Omdia, noted, “Chinese display makers are expanding the supply of high-quality AMOLED displays to Chinese smartphone brands at lower prices, rapidly replacing TFT LCDs in mid-range smartphones.”

Omdia’s short-term forecast predicts AMOLED will account for 53 percent of smartphone display shipments in the second quarter of 2024 and expand to 56 percent in the third quarter. The launch of the iPhone 16 is expected to further boost AMOLED shipments in the fourth quarter, solidifying AMOLED’s lead over TFT LCDs for the entire year and beyond.

Leading display manufacturers

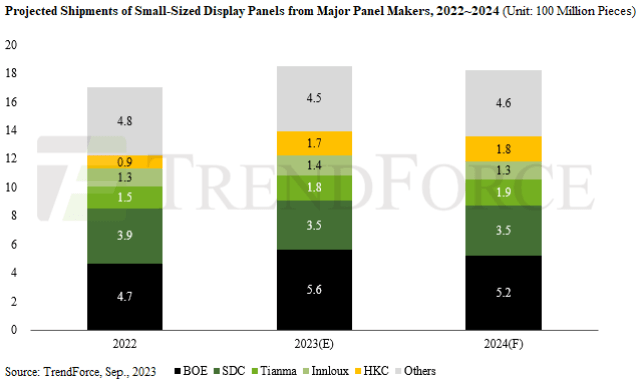

TrendForce projects a decline in smartphone panel shipments to 1.72 billion units in 2024, down 9 percent from the previous year. This follows an increase of 8.7 percent in 2023, with shipments reaching approximately 1.85 billion units, driven by the demand for smartphone repairs, second-hand devices, and new model releases.

Looking ahead, TrendForce anticipates a normalization of supply-demand dynamics in the smartphone market, potentially reducing the demand for second-hand devices and repairs. Among individual panel makers, the decline in LCD panel demand is a shared challenge.

BOE remains the leader in global smartphone panel shipments, with an estimated 560 million pieces for 2023. However, 2024 projections indicate a 7.2 percent decline to around 520 million pieces due to weakening LCD demand. SDC, in second place, is expected to maintain steady shipments at around 350 million pieces, supported by demand from Samsung and Apple.

Tianma is projected to ship approximately 175 million pieces in 2023, securing third place, with a potential 5.2 percent increase to 190 million pieces in 2024. Innolux, ranked fourth, is expected to see an 11.2 percent decline to about 125 million pieces in 2024, driven by shrinking LCD demand.

HKC, in fifth place, is estimated to grow shipments from 170 million pieces in 2023 to 180 million pieces in 2024, a 4.2 percent increase, leveraging cost advantages from its G8.6 production lines.

TrendForce noted that SDC is the only top-five player experiencing a decline in shipments in 2023 due to decreasing demand for rigid AMOLED panels. The market share of rigid AMOLED panels from South Korean makers is diminishing as Chinese makers ramp up production of cost-competitive flexible AMOLED panels.

Baburajan Kizhakedath