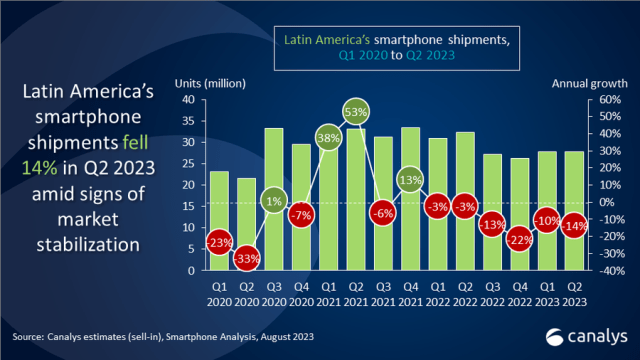

The smartphone market in Latin America has experienced a 14 percent year-on-year decline in shipments, totaling 28 million units, during the second quarter of 2023, according to the latest research by Canalys.

Despite this dip, the smartphone market in Latin America is displaying signs of stabilization and gradual recovery, buoyed by heightened consumer confidence, improved inventory management, and strategic shifts by smartphone vendors towards key market segments, Canalys said in its report.

Despite this dip, the smartphone market in Latin America is displaying signs of stabilization and gradual recovery, buoyed by heightened consumer confidence, improved inventory management, and strategic shifts by smartphone vendors towards key market segments, Canalys said in its report.

Miguel Perez, Senior Consultant at Canalys, attributed the subdued consumer demand to increased smartphone inventories held by vendors. This circumstance has prompted vendors to adopt a cautious approach, targeting specific segments of the market that offer better returns. Notable smartphone manufacturers like Samsung, Motorola, and Xiaomi faced double-digit declines in shipments, prompting them to adopt conservative strategies to mitigate overstocking and increase profitability.

Among the top three vendors, each is implementing distinct strategies to adapt to the evolving market landscape.

Samsung, for instance, is realigning its focus from the sub-US$200 price segment to higher-margin models within its portfolio.

Samsung, for instance, is realigning its focus from the sub-US$200 price segment to higher-margin models within its portfolio.

Motorola, after introducing the Moto Razr and Moto Edge 40 families, is concentrating on the low-end and mid-price segments with volume-driving models like Moto E13, G23, G13, and G53.

Xiaomi, rebounding from a Q1 2023 decline, is concentrating on models priced between US$100 and US$500, such as the Redmi Note 12 4G, Redmi 12C, A2, and Note 12S.

Beyond the top three vendors, Canalys observed notable expansion by other smartphone brands in the region.

Transsion, HONOR, and OPPO made significant strides in the Latin American market in Q2 2023. Transsion’s wide range of entry-level devices contributed to impressive performance in Colombia, Ecuador, and Peru.

HONOR achieved remarkable volume growth with a 168 percent year-on-year increase in shipments across Latin America.

OPPO, focusing on Colombia and Mexico, is investing significantly in channel marketing to establish a strong regional presence.

Latin America’s overall economic stability, despite varying socio-political landscapes, has created a favorable environment for the smartphone market. With controlled inflation and steady growth in economic powerhouses like Brazil, Mexico, and Colombia, the region is gaining attention as a target for smartphone market expansion. Although a slight 2 percent contraction is projected for 2023 as part of market stabilization, the outlook remains promising.

Improved consumer confidence and increased spending pave the way for potential growth in the latter half of the year, particularly with the peak sales season on the horizon. To seize this opportunity, brands are advised to refine their planning, establish robust channel partnerships, and ensure financial resilience, aligning their strategies with emerging prospects.