Analysts Canalys say worldwide smartphone market grew 12 percent in Q2 2024 to 288.9 million units. It’s time to salute innovators in the smartphone industry.

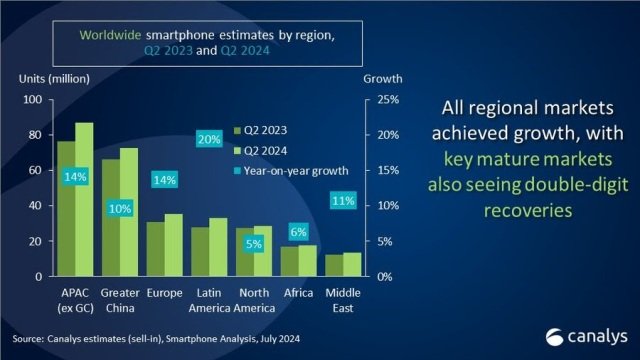

Growth in smartphone market was 14 percent in Asia Pacific, 10 percent in China, 14 percent in Europe, 20 percent in Latin America, 5 percent in North America, 6 percent in Africa and 11 percent in the Middle East.

The exciting fact is that the smartphone market has grown for three consecutive quarters, driven by product innovation initiatives and improvements in business conditions.

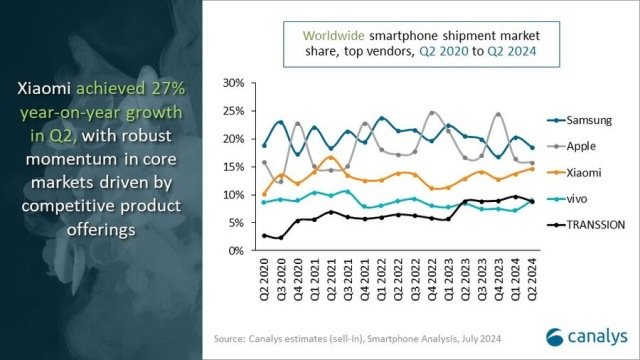

Samsung (53.5 million), Apple (45.6 million), Xiaomi (42.3 million), Vivo (25.9 million), TRANSSION (25.5 million), and Others (96.2 million) are the leading smartphone suppliers in Q2 2024.

Samsung, achieving 1 percent shipment increase, has retained its #1 rank in the global smartphone market with 53.5 million units.

Samsung’s high-end product lines boosted value growth. Samsung’s revamped 5G A series maintained overall numbers.

Apple held second place with 45.6 million units, bolstered by strong momentum in North America and APAC’s emerging markets.

Xiaomi, with its competitive product offerings, is the #3 smartphone brand. Xiaomi shipped 42.3 million units to achieve a market share of 15 percent.

Vivo, which ranked fourth, shipped 25.9 million units for a market share of 9 percent.

TRANSSION shipped 25.5 million units for a market share of 9 percent.

FOCUS AREAS

Apple and Samsung will focus on solidifying their long-term strategies in mature markets in the second half of 2024.

Other brands will hope to boost sales in emerging markets in the second half of 2024, having stocked channels in anticipation of higher operating costs.

Samsung will focus on integrating its Galaxy ecosystem to create value propositions for consumers via its flagship offerings with exclusive GenAI features.

Apple will look to accelerate replacement demand in mature markets via its AI strategy, with hybrid models, enhanced privacy and personalized Siri features.

Consumers and channel partners have adapted to promotions and cost-effective products in the fragile economic environment of the past two years.

The smartphone market is set to grow in the mid-single digits in 2024, driven by recovering inventory levels, eased import restrictions and a better economic climate.

In 2025, phone vendors should focus on delivering innovative smartphone experiences to attract upgrade buyers, build a distinctive brand image and strengthen local operations to seize emerging opportunities.

Baburajan Kizhakedath