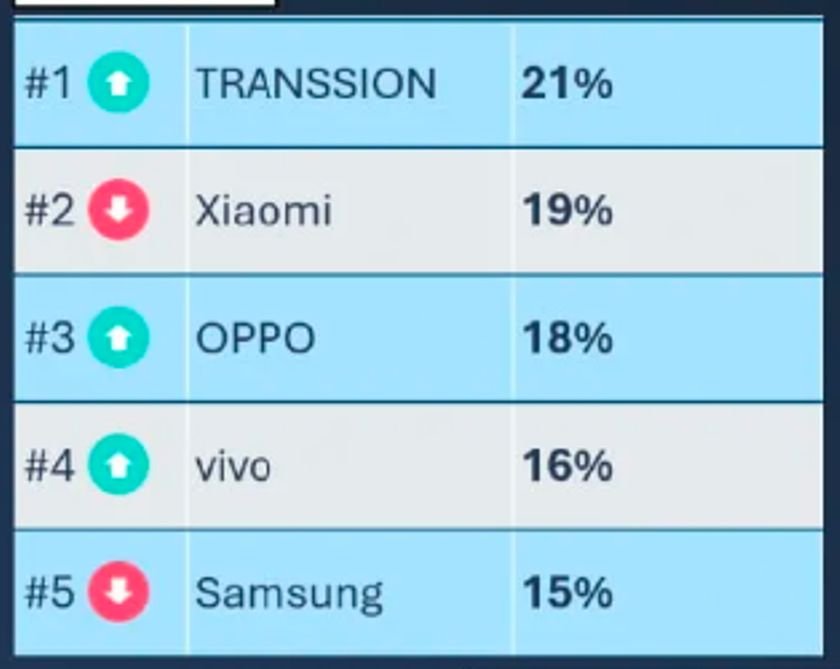

Indonesia’s smartphone market remained highly competitive in the third quarter of 2025, with clear shifts in vendor rankings driven by strong demand for affordable devices.

TRANSSION secured the top position with a 21 percent share, reflecting the brand’s momentum through its Infinix and TECNO portfolios. Its focus on value-driven features and aggressive pricing resonated well with Indonesia’s largely price-sensitive consumer base, according to the latest data from Omdia.

Xiaomi followed in second place with a 19 percent share. The brand benefited from steady demand for its Redmi and POCO models, particularly in the entry-level and lower mid-range segments. Enhanced distribution and frequent online promotions helped Xiaomi hold its position despite stronger competition.

OPPO ranked third with an 18 percent share. While still a major player in Indonesia’s mid-range market, OPPO’s performance reflects its strategic shift toward prioritizing value over volume. Channel adjustments and softer demand in some offline retail segments contributed to its more modest growth during the quarter.

vivo claimed the fourth spot with a 16 percent share, driven by the continued expansion of its Y-series lineup. The brand’s emphasis on large batteries, improved cameras and competitive pricing ensured steady uptake among younger consumers and first-time smartphone buyers.

Samsung placed fifth with a 15 percent share. Although the brand remains strong in Indonesia’s premium and upper mid-range categories, competition intensified within the budget-friendly segment, where Samsung faces tough pressure from Xiaomi and TRANSSION. However, the recent rollout of affordable Galaxy A series models is expected to help Samsung regain momentum in the coming quarters. Overall, Indonesia’s smartphone market in Q3 2025 remained heavily influenced by economic conditions, rising component costs and strong consumer preference for value-focused devices. With more than half of smartphones sold in the country priced below 200 US dollars, vendors are increasingly challenged to balance aggressive pricing with margin protection. As competition continues to intensify, brands with diversified portfolios, efficient channel strategies and strong entry-level offerings are best positioned to maintain leadership in the months ahead.