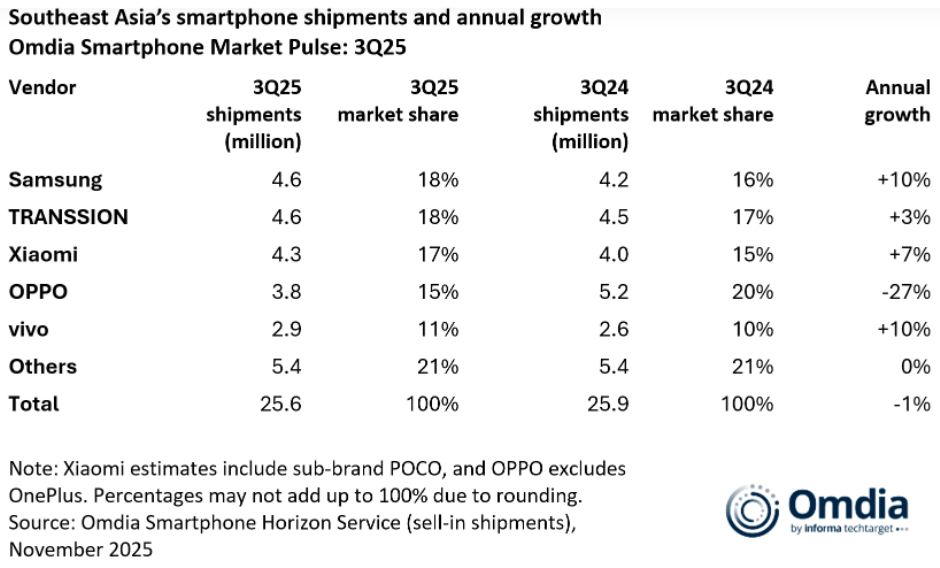

The Southeast Asia smartphone market saw a slight one percent decline in the third quarter of 2025, with total shipments reaching 25.6 million units. This marks the third consecutive quarter of year on year contraction, reflecting ongoing pressure in both premium and entry-level segments, according to the latest data from Omdia.

Samsung led the region with 4.6 million units and an 18 percent share, supported by strong performance in higher-ASP markets such as Thailand, Vietnam and Malaysia. Its premium-leaning strategy helped offset competitive pressure in Indonesia and the Philippines, where price sensitivity remains high.

TRANSSION followed closely with 4.6 million units and an 18 percent share, maintaining steady growth through its TECNO and Infinix brands. Xiaomi ranked third with 4.3 million units and a 17 percent share, aided by the strong momentum of its POCO series, which more than doubled shipments after new entry-level introductions.

OPPO shipped 3.8 million units for a 15 percent share, continuing to face weaker demand as it shifts toward a value-driven approach. vivo completed the top five with 2.9 million units and an 11 percent share, supported by the expansion of its Y-series lineup.

According to Omdia, volatility in the entry-level category remains a major factor shaping market leadership. Vendors such as OPPO and vivo are prioritizing profitability, while Xiaomi and HONOR are leaning into volume growth to widen market reach. HONOR’s X6c is a key example, with stronger channel coverage enabling the brand to more than double its 3Q24 shipments.

With inventories stabilizing after a soft first half of 2025, vendors are expected to adopt more aggressive strategies in the second half, including earlier product launches. However, rising memory and storage costs are creating new challenges, particularly in a region where more than 60 percent of smartphones are priced below 200 US dollars. Vendors will need to weigh whether to adjust retail prices, trim hardware features or reduce marketing investments to protect margins.

TRANSSION led shipments in Indonesia and the Philippines thanks to competitively priced models, though its ability to sustain aggressive pricing may be tested by rising component costs. Samsung maintained a strong lead in Thailand and Vietnam, supported by the early availability of its A17 and A07 series. In Malaysia, Xiaomi captured the top position, driven by the successful September launch of the Redmi 15 and its early 5G variant, reflecting growing demand for affordable 5G smartphones.