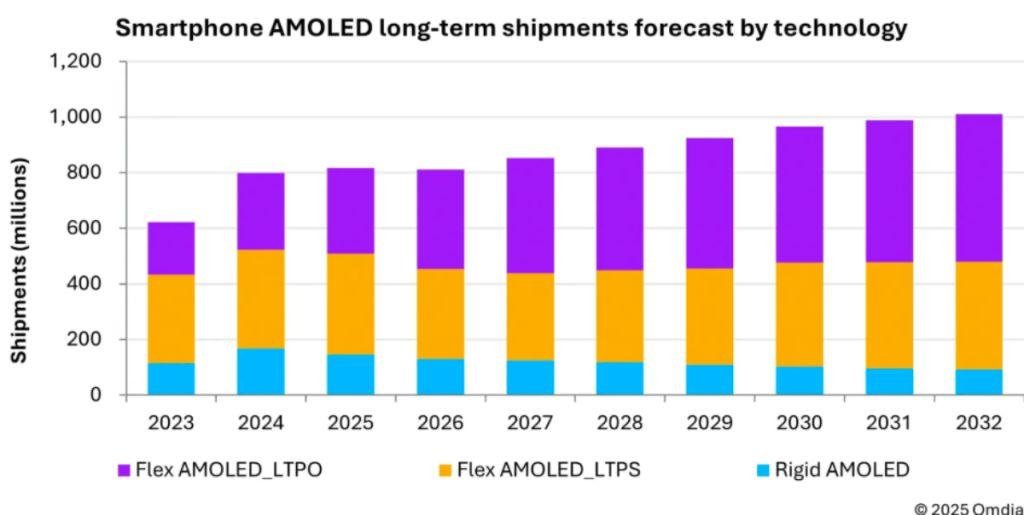

Global smartphone AMOLED display shipments are projected to decline to 810 million units in 2026, down from 817 million units in 2025, marking the first year-on-year contraction after three years of steady growth, according to Omdia.

The slowdown is primarily driven by a shortage of memory supply and sharply rising memory prices, prompting smartphone manufacturers to cut shipment and procurement plans for 2026, Omdia report said.

With manufacturers reluctant to pass higher memory costs on to consumers due to concerns over weaker demand and longer replacement cycles, pressure has shifted toward other components in the bill of materials. AMOLED panels, despite being in an expansion phase with ample capacity, have become a key target for cost reductions.

However, Omdia notes that the scope for further AMOLED price cuts is limited, as memory costs are now nearing or even exceeding display costs in some configurations, and panel makers had already implemented aggressive pricing reductions in 2025.

The current memory supply crunch is being fueled by surging demand from AI servers, which is tightening capacity across the electronics supply chain. In addition, geopolitical tensions, expectations of U.S. interest rate cuts, and a weaker dollar have attracted speculative capital into commodity markets, including semiconductors. This has pushed up prices of upstream materials, adding inflationary pressure on midstream and downstream electronics manufacturers.

Top smartphone AMOLED display makers

Samsung Display is the global leader in smartphone AMOLED panels. Samsung Display is making investment in advanced production technology, including large-generation (8.6-Gen) AMOLED lines targeting IT panels for laptops and other devices. This builds on its strong position supplying high-end displays for major customers like Apple and Samsung’s Galaxy series.

Samsung has been investing heavily in AMOLED fabs (8.6-Gen / IT OLED) to support panels for laptops and tablets. Recent investments of around 20 billion yuan (over USD 2.8 billion) have been reported in new 8.6-Gen production capacity alongside partnerships for high-end OLED production.

BOE Technology Group, China’s largest panel maker, has expanded its AMOLED footprint. It is investing about CNY 63 billion (roughly $8.8 billion) to build a new AMOLED production facility in Chengdu focused on mid-size OLED panels for laptops and tablets, with mass production expected by late 2026. BOE already operates multiple flexible AMOLED lines in Sichuan and Chongqing and is broadening its market beyond smartphones to IT applications.

Visionox is a key Chinese innovator in flexible AMOLED technology. Visionox has outlined investment plans including a roughly $7.6 billion 8.6-Gen production line in Hefei. This expansion aims to increase capacity for IT and consumer displays and deepen its role in flexible and transparent panel segments.

LG Display, while traditionally strong in large-format OLEDs, is accelerating its small-to-medium AMOLED investments, including more than $900 million (KRW 1.26 trillion) into next-generation OLED technologies and capacity upgrades. The focus includes automotive, mobile and laptop panel segments.

Joy Guo, Principal Analyst at Omdia’s Displays practice, Omdia, cautions that continued reliance on cost-down strategies focused on oversupplied components like AMOLED panels may face increasing resistance in this cycle. As upstream cost structures shift structurally while downstream planning remains rigid, supply chain risks are building, leading the research firm to maintain a cautious outlook for smartphone AMOLED shipments in 2026.

BABURAJAN KIZHAKEDATH