Tele2 reported steady revenue growth in the fourth quarter and full year 2025, supported by subscriber additions, higher ARPU and disciplined capital expenditure as the operator sharpened its focus on 5G and digital efficiency.

Revenue performance

Tele2 said end-user service revenue reached SEK 5.6 billion in the fourth quarter, up 4 percent organically compared to Q4 2024, driven by growth across all operations. Total revenue for the quarter rose 4 percent organically to SEK 8.0 billion.

For full year 2025, end-user service revenue increased 2.3 percent organically to SEK 22.146 billion, while total revenue grew 1.8 percent to SEK 29.89 billion. The company said growth was broad-based across Sweden and the Baltics, supported by mobile, fixed broadband and solutions.

Tele2 has generated revenue of SEK 22,888 million from Sweden, SEK 4,095 million from Lithuania, SEK 2,054 million from Latvia, SEK 991 million from Estonia in 2025.

Capex discipline and outlook

Tele2 continued to optimize investments in 2025. Fourth-quarter capex paid excluding spectrum declined to SEK 928 million, down from SEK 1,032 million a year earlier, reflecting reduced investments and the deferral of some projects into 2026. Spectrum capex paid increased to SEK 362 million due to the final payment for Swedish spectrum acquired in 2023.

For the full year, capex paid excluding spectrum fell to SEK 3,328 million from SEK 3,960 million, while spectrum capex paid rose to SEK 365 million, again linked to the final spectrum payment.

Tele2’s Capex was SEK 2,627 million in Sweden, SEK 253 million in Lithuania, SEK 217 million in Latvia, SEK 143 million in Estonia in 2025.

Jean Marc Harion, President and Group CEO, said the shutdown of Tele2’s Swedish 2G and 3G networks in early December marked an important milestone, allowing the company to fully focus on improving its 5G network.

Subscribers and ARPU trends

In Sweden Consumer, fourth-quarter revenue grew 2 percent to SEK 3,194 million as growth in mobile and fixed broadband more than offset the continued decline in legacy fixed services and the impact of migrating Boxer off the terrestrial network.

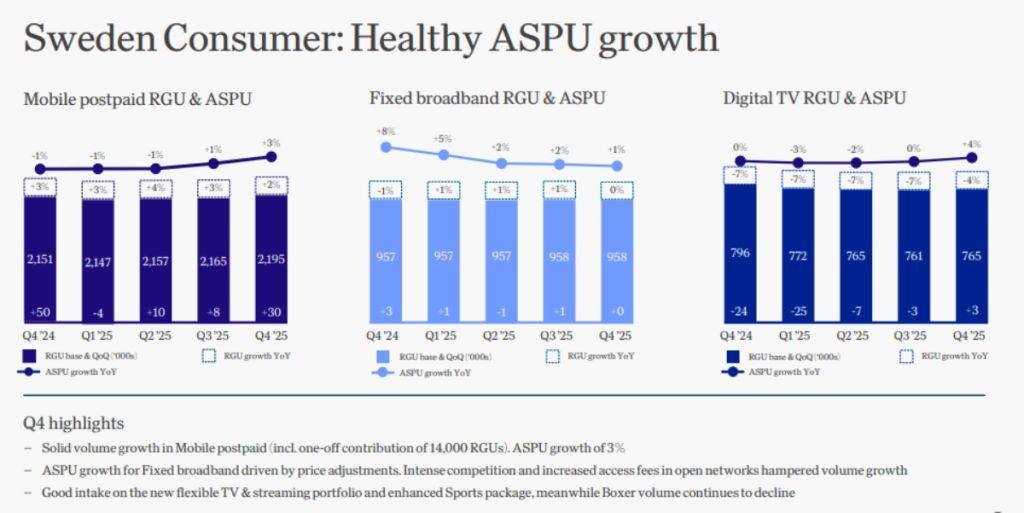

Mobile postpaid delivered positive net intake of 30,000 RGUs in the quarter, including 14,000 from a one-off recognition of previously uncounted low-ASPU RGUs. Mobile end-user service revenue increased 4 percent, driven by growth in postpaid ARPU and subscriber base, which more than compensated for a 5 percent decline in prepaid revenue.

Fixed broadband net intake was neutral, but end-user service revenue grew 2 percent, mainly due to ARPU expansion. Digital TV recorded positive net intake of 3,000 RGUs, while the new TV service delivered mid single-digit revenue growth. Total Digital TV end-user service revenue declined 1 percent, reflecting the ongoing impact from Boxer.

Sweden Business revenue rose 7 percent to SEK 1,152 million, supported by growth in mobile and solutions. In the Baltics, revenue increased 6 percent to SEK 1,274 million, driven by ASPU growth from price adjustments and upselling.

Looking ahead, Tele2 guides for organic low single-digit end-user service revenue growth in 2026 and organic underlying EBITDAaL growth in the low to mid single-digit range. The company expects capex to sales to be around 10 to 11 percent.

Tele2 also highlighted continued efficiency initiatives, noting that automation efforts and AI usage accelerated in 2025 and will continue at pace in 2026, alongside brand investments aimed at sustaining subscriber growth and ARPU momentum.

BABURAJAN KIZHAKEDATH