The Middle East smartphone market delivered strong momentum in 2025, and new research report from Omdia highlights how Samsung is consolidating its position as a leading growth driver in the region’s premium and mid-range segments.

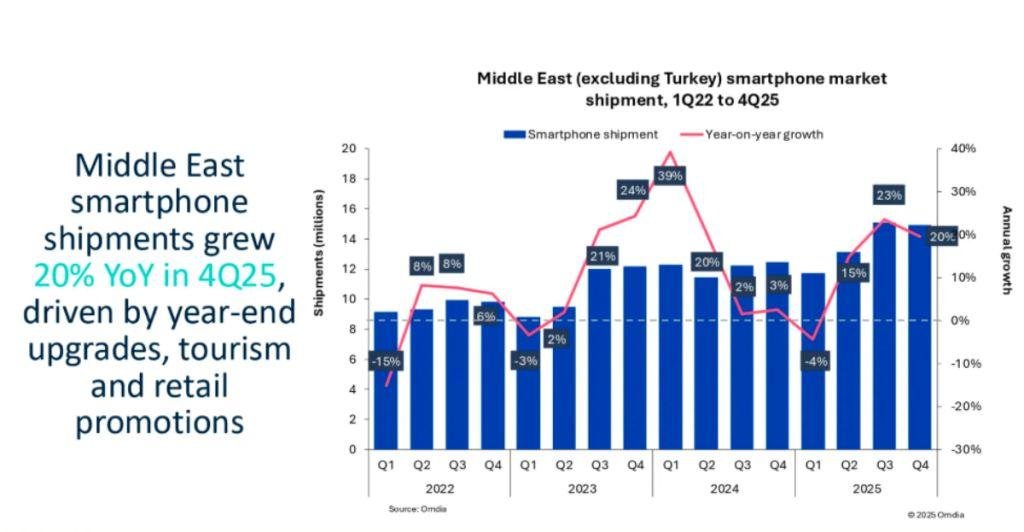

Middle East smartphone market posts third year of double-digit growth

According to Omdia, smartphone shipments in the Middle East (excluding Turkey) reached 54.8 million units in 2025, rising 13 percent and marking the third consecutive year of double-digit expansion. The market closed the year strongly, with 4Q25 shipments increasing 20 percent to 14.9 million units.

Growth was fueled by:

Flagship smartphone launches

Expansion of financing and trade-in programs

Strong retail demand linked to tourism and holiday shopping

Ongoing upgrade cycles across Gulf markets

The region is gradually shifting toward a more mature and value-focused market, where profitability and brand positioning are becoming as important as shipment volumes.

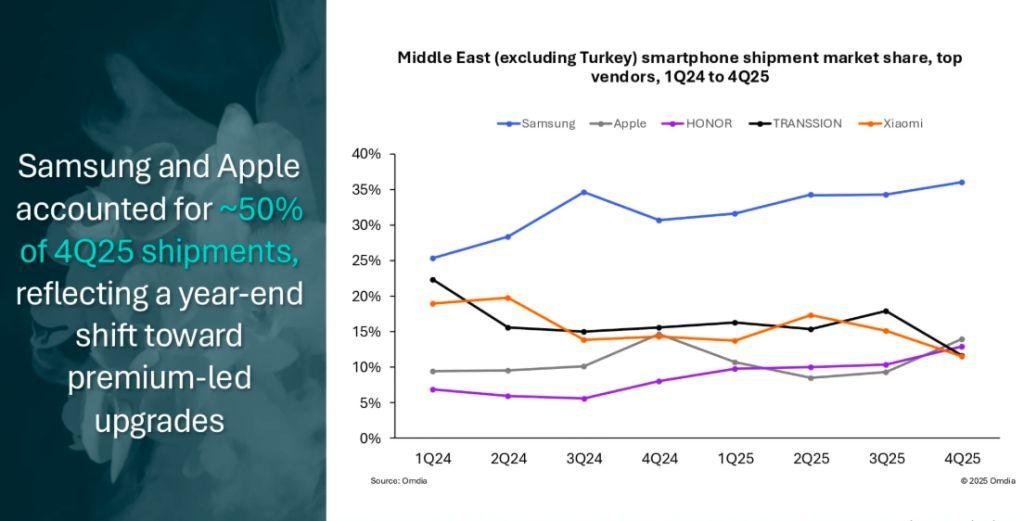

Samsung and Apple dominate year-end upgrade cycle

Apple and Samsung together accounted for around half of all shipments in 4Q25, underscoring the strength of premium ecosystems and brand loyalty.

Samsung’s growth was driven by a balanced strategy combining flagship innovation with strong volume models. Its premium lineup boosted upgrade demand, while mid-range and entry models expanded reach across price-sensitive segments.

Analysts highlighted that upgrade demand in the region is increasingly concentrated around brands with strong portfolios, financing support and retail presence.

Gulf markets lead replacement-driven growth

Key Gulf countries played a major role in sustaining smartphone momentum:

Saudi Arabia remained the largest market, growing 14 percent year on year and accounting for about 27 percent of shipments.

United Arab Emirates expanded 12 percent, supported by product refresh cycles and promotional activity.

Kuwait grew 8 percent and Qatar rose 6 percent, reflecting steady replacement demand.

Iraq maintained meaningful scale despite market volatility.

These markets benefit from mature financing ecosystems, strong tourism flows and high consumer interest in premium devices – all of which support Samsung’s growth strategy.

Competition intensifies but Samsung remains resilient

While Samsung and Apple maintained stability, other vendors experienced mixed performance:

HONOR was the fastest-growing major vendor, with shipments rising 94 percent year on year.

TRANSSION saw shipment declines but continued shifting toward value-focused products through its brand TECNO.

Xiaomi recorded a modest decline due to reliance on entry-level volumes.

Rising component costs and selective supply conditions are expected to create further pressure on volume-driven Chinese OEMs, strengthening Samsung’s relative stability.

2026 outlook: Stable leaders despite shipment slowdown

Looking ahead, smartphone shipments in the region are projected to decline 8 percent in 2026 due to tighter supply conditions and affordability pressures.

However, Samsung and Apple are expected to remain comparatively stable as vendors prioritize scale markets such as Saudi Arabia and the UAE, where premium demand remains strong.

Beyond 2026, the Middle East smartphone market is forecast to shift toward steady replacement-led growth, reducing the sharp fluctuations seen in recent years. For Samsung, this transition favors its strategy of combining premium innovation with broad portfolio coverage – positioning the company for sustained leadership in the region.

BABURAJAN KIZHAKEDATH