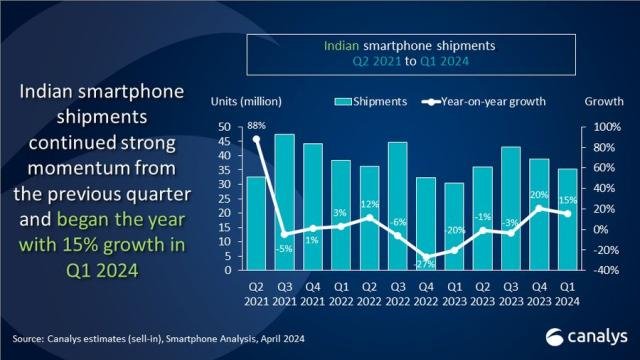

Indian smartphone market has experienced a 15 percent year-on-year growth, with shipments reaching 35.3 million units during the first quarter of 2024, according to the latest research from Canalys.

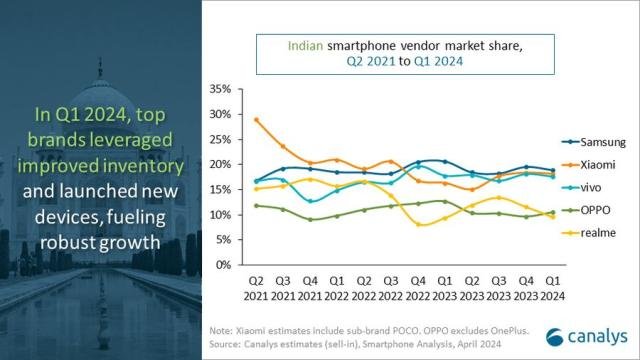

Maintaining its dominance, Samsung has secured the top position in Q1 2024, capturing a 19 percent market share with 6.7 million units shipped. The success can be attributed to the strong performance of Samsung’s latest flagship model, the Galaxy S24, which saw increased demand compared to its predecessor. This surge was fueled by attractive pre-booking offers, Samsung Finance+, and a comprehensive marketing campaign highlighting advanced AI features.

Maintaining its dominance, Samsung has secured the top position in Q1 2024, capturing a 19 percent market share with 6.7 million units shipped. The success can be attributed to the strong performance of Samsung’s latest flagship model, the Galaxy S24, which saw increased demand compared to its predecessor. This surge was fueled by attractive pre-booking offers, Samsung Finance+, and a comprehensive marketing campaign highlighting advanced AI features.

Securing the second spot, Xiaomi shipped 6.4 million units driven by its mass-market 5G strategy. The company experienced a robust resurgence in Q1, powered by the popularity of models like the Redmi 13C 5G and Redmi Note 13 5G series, along with the early launch of POCO’s X6 series.

Vivo claimed the third position with 6.2 million units shipped, while Oppo (excluding OnePlus) shipped 3.7 million units, experiencing a modest decline due to a streamlined portfolio with fewer new releases in the mid-high price ranges. Realme followed closely behind with 3.4 million units shipped.

According to Canalys Senior Analyst Sanyam Chaurasia, vendors’ price correction and promotional strategies in Q4 2023 facilitated inventory management in Q1. Notably, Motorola, Infinix, and Apple achieved high double-digit growth, narrowing the market share gap from the top players.

According to Canalys Senior Analyst Sanyam Chaurasia, vendors’ price correction and promotional strategies in Q4 2023 facilitated inventory management in Q1. Notably, Motorola, Infinix, and Apple achieved high double-digit growth, narrowing the market share gap from the top players.

Apple’s growth was particularly driven by discounts and promotional deals on its iPhone 15 model.

Furthermore, leading brands like Xiaomi, Vivo, and Oppo introduced their latest models, such as the Redmi Note 13, V30, and Reno 11 series, at higher price points compared to previous generations. This aggressive pricing strategy aims to capitalize on the trend of premiumization, fueled by wider channel access and easy financing options.

However, operational pressures, including higher component costs, are expected to result in continued price hikes despite import duty reductions on certain parts. Brands are also prioritizing channel incentives and retail investments, contributing to rising costs. Looking ahead, brands will seek to justify incremental pricing beyond 5G capabilities as they navigate the evolving market landscape.