The latest IDC report has details about the China smartphone purchasing trends, growth in the market in 2024, and future predictions for 2025.

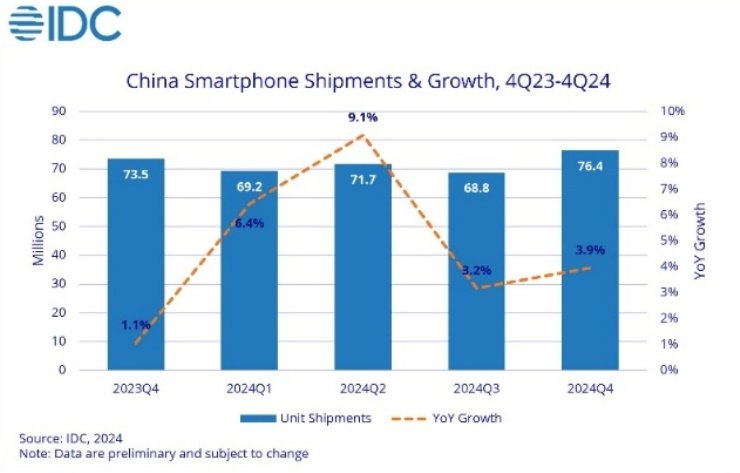

In 4Q24, China’s smartphone market shipped 76.4 million units, reflecting a 3.9 percent year-on-year (YoY) growth driven by new product launches and government subsidies in certain regions.

In 2024, shipments totaled 286.2 million units, representing a 5.6 percent increase, signaling recovery after two years of decline due to pent-up demand and innovations like generative AI (GenAI).

Will Wong, senior research manager for Client Devices at IDC Asia Pacific, said: “This implies a value-seeking trend that is prevalent not only in China but also globally. Market players need to adapt to this shift in consumer behavior if they want to continue to capitalize on the recovery.”

Vivo (17.2 percent), Huawei (16.6 percent), Apple (15.6 percent), Honor (14.9 percent), and OPPO (14.8 percent) are the leading smartphone brands in China in 2024.

In Q4 2024, the leading smartphone brands in China are Apple (17.4 percent), Vivo (17.2 percent), Huawei (16.2 percent), Xiaomi (16 percent), Honor (13.7 percent) and OPPO (13.7 percent).

Vivo led the Chinese smartphone market in 2024, leveraging a user-centric approach across all price segments and emphasizing both hardware and software development.

Huawei experienced over 50 percent growth in shipments, achieving second place for the year, thanks to improved supply chain capabilities and its strong market comeback.

Apple claimed the top spot in 4Q24 but faced a decline in annual market share and shipments due to heightened competition and uncertainties surrounding the launch of Apple Intelligence in China.

Honor remained one of the top five smartphone vendors by focusing on product differentiation and innovation, while also achieving growth in international markets.

OPPO rebounded with shipment growth in 4Q24, driven by its investments in mid- to high-end products and the success of its Find X8 series.

The value-seeking trend among consumers became more pronounced, requiring smartphone OEMs to adapt strategies to cater to this shift in behavior.

Government subsidies in certain provinces and cities played a significant role in driving market recovery and are expected to continue supporting growth in 2025.

The Chinese smartphone market recovery highlights uneven benefits among OEMs, with consumer selectivity favoring brands that prioritize innovation and value.

Baburajan Kizhakedath