The latest research reports from Canalys and IDC have indicated that Vivo has retained its lead in the China smartphone market in Q3 2024.

Canalys report

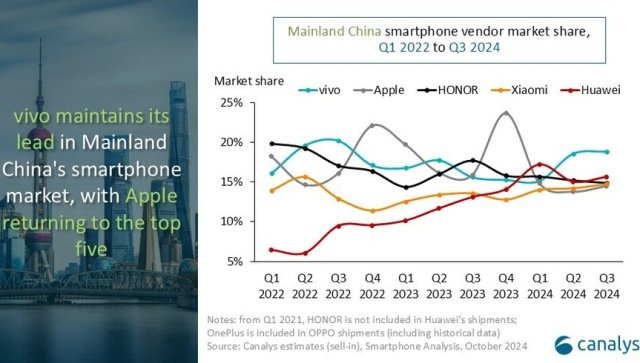

In Q3 2024, Vivo retained its lead in China’s smartphone market with a 19 percent share, largely due to its strategic launches in the mid-range segment and a dual-channel approach that strengthened both its offline sales and online presence.

According to Canalys, Vivo shipped 13.0 million units, a 25 percent increase year over year, benefiting from a market uptick due to summer and back-to-school shopping seasons.

Vivo’s focus on mid-range products aimed at the mass market appealed to budget-conscious consumers, particularly students and young professionals. By launching feature-rich but affordable 5G devices with improved durability and battery life, Vivo targeted consumers who seek upgrades without the premium price tag.

Moreover, its channel strategy, which balances partnerships with offline retailers and an expanding online presence, allowed Vivo to capture both foot traffic and e-commerce demand.

As brands like Huawei and HONOR faced challenges in their respective market segments, Vivo’s steady growth reflects its adaptability in addressing China’s evolving consumer base, coupled with innovative strategies to enhance visibility across shopping platforms.

“The Mainland China smartphone market has entered its most active period of the year, with consumer demand continuing from last quarter’s e-commerce sales into the summer,” said Canalys Research Manager Amber Liu. “Vendors are optimizing inventories and launching new products in preparation for the upcoming shopping season.”

Vivo (19 percent), Huawei (16 percent), Honor (15 percent), Xiaomi (15 percent) and Apple (14 percent) are the leading smartphone brands in China in Q3 2024, according to Canalys. The size of the China smartphone market was 69.1 million units in 3Q24.

IDC report

In Q3 2024, Vivo retained its lead in the Chinese smartphone market by leveraging a well-defined product strategy and dynamic market positioning. Vivo captured share of 18.6 percent through its main and sub-brands, which target varied segments and needs across consumer groups, IDC said.

Vivo’s strength in maintaining top position lay in its ability to appeal to both mid-range and premium consumers. Its diverse portfolio, bolstered by an ongoing expansion in the 5G and mass-market segments, attracted many looking to upgrade amid a wave of pent-up demand. This product diversity allowed Vivo to offer feature-rich smartphones tailored to different price points, effectively reaching consumers from budget to premium segments.

Vivo’s commitment to innovation — particularly in the Android market — supported robust double-digit growth alongside competitors like Huawei and Xiaomi. The brand’s distinct offerings allowed it to differentiate within a crowded market, strengthening its foothold through both physical retail and online channels. As the fourth quarter approaches, Vivo’s strategic preparation for Singles Day and new flagship releases position it well to continue capitalizing on seasonal demand and competitive positioning.

“We anticipate the positive growth trajectory to continue into the fourth quarter,” said Jacob Zhu, research analyst for Client Devices at IDC Asia/Pacific. “This momentum will be bolstered by the early release of flagship models from leading brands, as well as the early kick-off of the Singles Day shopping festival.”

Vivo (18.6 percent), Apple (15.6 percent), Huawei (15.3 percent), Xiaomi (14.8 percent) and Honor (14.6 percent) are the leading smartphone brands in China in Q3 2024, according to IDC. The size of the China smartphone market was 68.8 million units in 3Q24.

Baburajan Kizhakedath