Apple has lost its top position in the 285 million Chinese smartphone market in 2024 due to intensified competition from domestic brands, shifting consumer preferences, and strategic innovations by rivals.

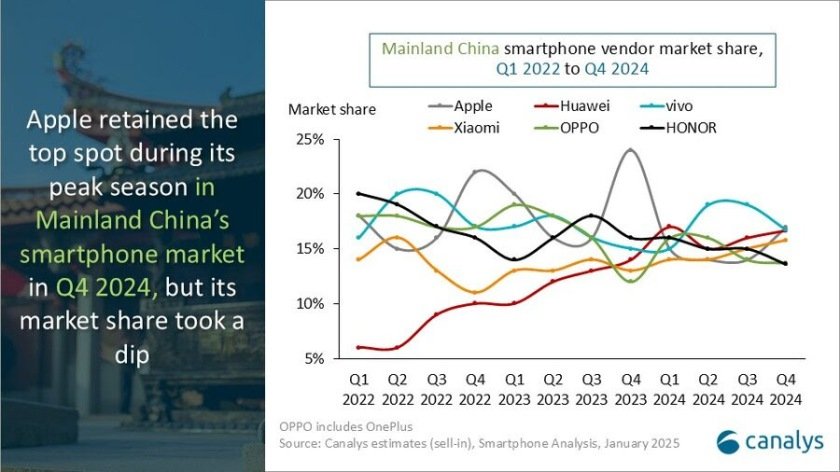

Apple’s share in China smartphone market fell to 15 percent in 2024 as compared with 19 percent share in 2023. Vivo, the leader in China smartphone market, has increased its share to 17 percent in 2024 from 16 percent in 2023. Huawei has increased its share to 16 percent in 2024 from 12 percent in 2023.

Amber Liu, Research Manager, in Canalys report, said Apple’s annual shipments in China fell by 17 percent, marking its largest-ever sales decline in the region. This drop was consistent across all four quarters, including a significant 25 percent decrease in the final quarter, resulting in Apple falling to third place with a 15 percent market share.

Vivo and Huawei overtook Apple, capturing 17 percent and 16 percent of the market, respectively, driven by their focus on technological advancements and strategic positioning across various price segments.

Huawei’s resurgence, fueled by its locally produced chipsets and innovations such as foldable designs and the HarmonyOS NEXT operating system, contributed significantly to Apple’s loss of market dominance.

Despite previously benefiting from Huawei’s struggles due to U.S. sanctions, Apple could not counter the brand’s strong comeback, which included a 24 percent rise in Q4 shipments. Vivo also strengthened its position by capitalizing on marketing, partnerships, and robust product strategies targeting entry-level and premium consumers.

The absence of cutting-edge artificial intelligence features in Apple’s latest iPhones further weakened its appeal, as domestic brands increasingly prioritized AI-powered capabilities to attract consumers in China.

Meanwhile, budget-friendly competitors like Xiaomi have achieved significant growth, with a 29 percent increase in Q4 shipments, supported by ecosystem integrations and competitive pricing. Other domestic players like Oppo and Vivo also posted double-digit growth, further eroding Apple’s market share.

Apple attempted to address the decline through rare price cuts and promotional campaigns, including discounts of up to 500 yuan on its iPhone 16 series. Major e-commerce platforms, such as Alibaba’s Tmall, supported these efforts with additional discounts. However, these measures proved insufficient to offset the growing appeal of domestic brands offering value-added products at more competitive prices, Reuters news report said.

In 2024, China’s smartphone market grew by 4 percent to 285 million units, reflecting a recovering demand environment.

Apple’s performance underscores the challenges it faces in maintaining relevance in a market dominated by innovative and aggressively priced domestic brands. Looking ahead, Apple will need to differentiate its products further, address pricing challenges, and compete more effectively against increasingly sophisticated local competitors to regain its leadership position.

Baburajan Kizhakedath