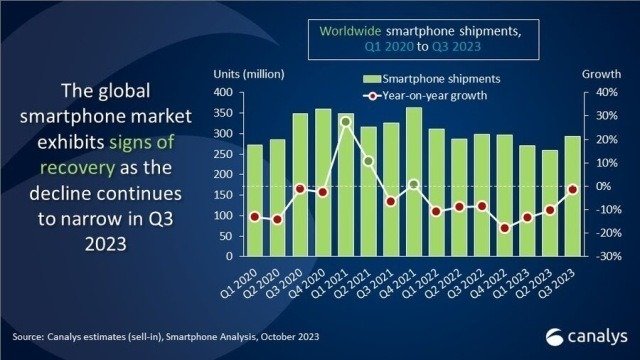

The global smartphone market experienced a minor decline of 1 percent in the third quarter of 2023, according to the latest data from Canalys.

This dip, signaling a slowdown in the market’s decline, was offset by regional recoveries and increased demand for new product upgrades, resulting in double-digit sequential growth ahead of the upcoming sales seasons, the report said.

This dip, signaling a slowdown in the market’s decline, was offset by regional recoveries and increased demand for new product upgrades, resulting in double-digit sequential growth ahead of the upcoming sales seasons, the report said.

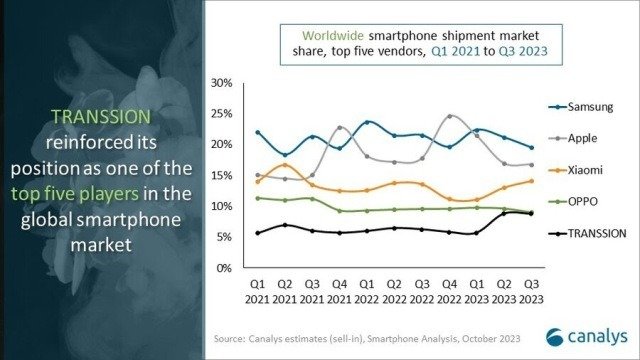

Samsung maintained its position as the market leader with a 20 percent market share, despite a slight decrease from the same period in 2022.

Apple secured the second position with a 17 percent market share, while Xiaomi claimed the third spot with a 14 percent market share, showcasing recovery in unit shipments both annually and sequentially.

OPPO (including OnePlus) secured the fourth position with a 9 percent market share, primarily due to its strong presence in the Asia Pacific region.

TRANSSION rounded out the top five with a 9 percent market share and notable year-over-year expansion.

Huawei, outside the top five, made a significant comeback in its home market, driven by the launch of the new Mate series.

Amber Liu, analyst at Canalys, highlighted the impact of Huawei and Apple’s new launches in stimulating market excitement.

Amber Liu, analyst at Canalys, highlighted the impact of Huawei and Apple’s new launches in stimulating market excitement.

Huawei’s new Mate series, featuring the latest Kirin chipset, garnered enthusiastic consumer response in Mainland China, prompting operators to stock up on Huawei devices to meet the soaring demand. Meanwhile, Apple’s enhanced performance and feature-rich iPhone 15 series continuously stimulated demand.

Amidst these developments, Samsung’s strategic focus on profitability, Xiaomi and TRANSSION’s competitive products, and Huawei’s resurgence underscore a shifting landscape. Amber Liu also emphasized the importance of careful market strategy for emerging players like Xiaomi and TRANSSION, suggesting that short-term successes could translate into long-term gains with prudent planning.

Toby Zhu, analyst at Canalys, urged vendors to exercise caution in light of global macroeconomic and geopolitical uncertainties that have introduced fragility into the nascent recovery and channel operations.

Canalys forecasts foresee a deceleration in medium-to-long-term smartphone market growth. Zhu advised vendors to monitor stock turnover and end demand meticulously, considering potential turbulence from high inventory.

He also noted the need for strategic rebuilding of channel and component inventories to prepare for potential resurgent demand and potential supply chain cost hikes. The current short-term order surge, coupled with reduced supply capacity, may lead to component shortages, posing challenges in planning and production.