Canalys said the Latin American smartphone market witnessed a growth of 20 percent during the fourth quarter of 2023.

The surge in the Latin American smartphone market was propelled by concerted efforts from phone brands and channels to replenish inventories, coupled with a resurgence of socio-economic stability in key nations. This stability bolstered consumer confidence and drove heightened consumption during the peak holiday sales period.

The surge in the Latin American smartphone market was propelled by concerted efforts from phone brands and channels to replenish inventories, coupled with a resurgence of socio-economic stability in key nations. This stability bolstered consumer confidence and drove heightened consumption during the peak holiday sales period.

For the entire year of 2023, the market experienced a 2 percent growth, reaching a total of 118.9 million units. The latter half of 2023 demonstrated signs of recovery, offsetting the decline experienced in the initial two quarters, primarily due to a favorable device replacement cycle.

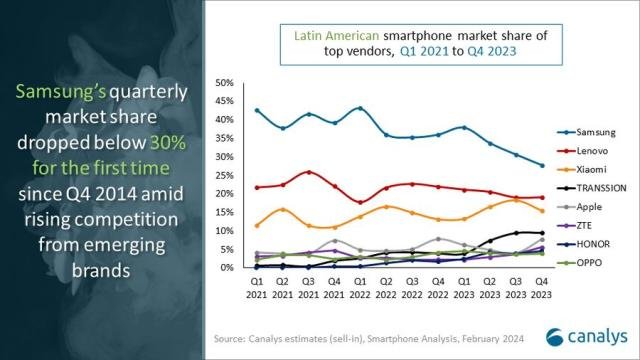

Leading the market in Q4 2023 was Samsung, although its market share dipped below 30 percent for the first time since Q4 2014. This decline was attributed to the ascent of challenger brands such as Xiaomi, TRANSSION, and ZTE, particularly in the entry-level segment.

Miguel Perez, Senior Consultant at Canalys, noted, “Unlike some Chinese brands seizing market share in the region, Samsung and Motorola have pivoted their long-term strategies, transitioning from a volume-centric approach to prioritizing profitability through business segmentation.”

Miguel Perez further elaborated on the strategies employed by Samsung and Motorola, with Samsung focusing on mid-to-high range and premium segments, while Motorola solidified its position by fostering partnerships with major operators and retailers.

Miguel Perez further elaborated on the strategies employed by Samsung and Motorola, with Samsung focusing on mid-to-high range and premium segments, while Motorola solidified its position by fostering partnerships with major operators and retailers.

Outside of the top players, several vendors contributed significantly to the market’s growth. Xiaomi, for instance, strengthened its carrier ties and expanded its presence in key markets, resulting in a remarkable 42 percent annual growth. TRANSSION’s Infinix and Tecno brands experienced a staggering 188 percent growth in untapped markets, targeting value-conscious young consumers.

Moreover, Apple witnessed a 20 percent annual growth, propelled by its success in key markets like Brazil and Mexico. Other noteworthy performers included ZTE and HONOR, both achieving triple-digit shipment growth, with ZTE re-establishing significant shipments in Mexico and HONOR showcasing consistent quarterly growth.

Looking ahead, Canalys forecasts a modest 3 percent growth in the Latin America smartphone market for 2024. This growth is anticipated to be supported by continued interest rate adjustments aimed at boosting consumer confidence, along with healthier inventories facilitating the introduction of new models.

Emerging smartphone brands in the low to mid-range segment are expected to emphasize affordable value propositions, while top players will focus on strengthening their positioning in the premium segment through AI-driven strategies and enhanced channel partnerships.