The latest research from Canalys sheds light on the performance of the Southeast Asia smartphone market in the fourth quarter of 2023, indicating a 4 percent year-on-year growth to 23.8 million units.

Despite a sluggish start marked by macroeconomic challenges and inflationary pressures, the Southeast Asia region witnessed a resurgence in consumer demand for smartphones, fueled by aggressive product launches and channel incentives.

Analyst Sheng Win Chow from Canalys in its research report commented on the smartphone market dynamics, noting that smartphone manufacturers capitalized on the upward trajectory of economic recovery.

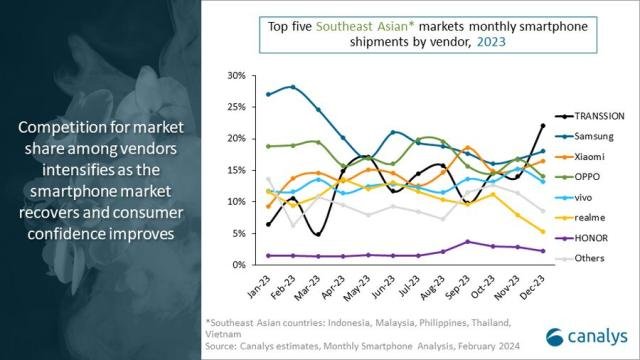

Samsung maintained its leading position in Southeast Asia with an 18 percent smartphone market share, albeit experiencing a 17 percent decline compared to the previous year. The company’s strategic shift towards bolstering the premium segment affected the competitiveness of its lower-end models against other Android brands.

Notably, TRANSSION secured second place for the first time, capturing a 16 percent smartphone market share and achieving an impressive 153 percent year-over-year growth, driven by strong performance in Indonesia, the Philippines, and new markets.

Xiaomi and Oppo held a 15 percent market share each, with Xiaomi witnessing a 44 percent growth and Oppo facing a 27 percent decline year-over-year. Xiaomi’s consolidation of its product lineup resulted in competitive pricing, boosting sales volume.

Conversely, Oppo’s branding efforts improved, but it encountered challenges in volume competition due to the absence of a product tailored to the ultra-low-end market segment.

In the Philippines, the smartphone market experienced significant resurgence with a 32 percent year-on-year growth, led by Transsion’s increased shipments and effective promotional strategies.

Malaysia has witnessed robust growth in smartphone business driven by government initiatives promoting 5G adoption.

Malaysia has witnessed robust growth in smartphone business driven by government initiatives promoting 5G adoption.

However, Vietnam’s smartphone market recovery progressed slower than anticipated, with key distributors redirecting investments towards emerging sectors like AI.

Devices priced below US$299 continued to dominate sales, comprising 82 percent of total volume in Q4 2023. Transsion led smartphone shipments to the region in December for the first time. However, heightened price competition and market saturation posed challenges for vendors in pricing and positioning products.

Looking ahead, Canalys predicts a 7 percent growth in smartphone shipments in Southeast Asia for 2024.

Despite concerns about high interest rates and inflation affecting consumer purchasing behavior, the demand for 5G devices is expected to continue growing, driven by affordability improvements and government initiatives.

Smartphone vendors will need to innovate and adapt to evolving trends such as AI and ecosystem optimization to drive end-user adoption effectively.