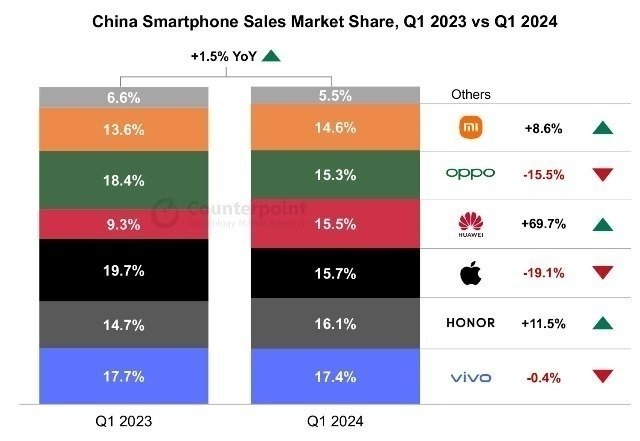

China’s smartphone sales have shown a steady uptick, registering a 1.5 percent year-on-year growth in the first quarter of 2024. This marks the second consecutive quarter of positive year-on-year growth for the Chinese smartphone market, according to Counterpoint Research report.

Huawei has emerged as the frontrunner among all smartphone vendors during Q1, boasting 69.7 percent growth. This surge in Huawei’s sales can be attributed to the debut of its 5G-enabled Mate 60 series, coupled with its brand reputation. Notably, Huawei made significant strides in capturing a substantial share in the premium segment of smartphones priced above $600.

Huawei has emerged as the frontrunner among all smartphone vendors during Q1, boasting 69.7 percent growth. This surge in Huawei’s sales can be attributed to the debut of its 5G-enabled Mate 60 series, coupled with its brand reputation. Notably, Huawei made significant strides in capturing a substantial share in the premium segment of smartphones priced above $600.

Despite Huawei’s resurgence, HONOR also experienced growth, recording an 11.5 percent increase in Q1. This growth for HONOR was fueled by the popularity of its models such as the X50 and Play 40, along with its strategic expansion in offline channels.

Momentum appears to be building towards recovery as China’s smartphone sales maintain their growth trajectory, expanding by 4.6 percent quarter-on-quarter in Q1 2024, Associate Director Ethan Qi said.

Senior Analyst Mengmeng Zhang highlighted the competitive strategies adopted by smartphone OEMs, particularly focusing on the surge in sales within the low-end segment during the festive period, driven by affordable offerings targeted at migrant workers.

Vivo secured 17.4 percent market share, driven by sales of its Y35 Plus and Y36 models in the low-end segment.

HONOR claimed the second position with 16.1 percent share, while Apple followed with a 15.7 percent share. Apple faced subdued sales during the quarter, partly due to Huawei’s resurgence impacting its premium segment sales.

Counterpoint Research anticipates low single-digit growth for China’s smartphone market in 2024, with the integration of generative AI features expected to drive innovation among Chinese OEMs, particularly in flagship devices. These advancements are poised to trickle down to the mid-end segment, further enhancing the competitive landscape in China’s vibrant smartphone market.

TelecomLead.com News Desk