Chipmaker STMicroelectronics has revised its full-year revenue and margin guidance downward for the second time this year, citing weak industrial orders and reduced demand for automotive chips.

Key clients of STMicroelectronics include Apple, Bosch, Continental, Delta Electronics, HP, Huawei, Intel-Mobileye, Samsung, Seagate and Tesla.

STMicroelectronics expects revenue for 2024 to be between $13.2 billion and $13.7 billion, a decrease from the previous forecast of $14 billion to $15 billion. Additionally, margin forecasts have been adjusted to around 40 percent, down from the “low 40s.”

STMicroelectronics CEO Jean-Marc Chery said: “We are facing a longer and more pronounced correction in industrial than what we anticipated due to a progressive weakening of demand amplified by a severe inventory correction.”

The demand for electric vehicles (EVs) has also slowed significantly in Europe, with sales rising only 1.3 percent in the first half of the year, Reuters news report said.

Despite these challenges, STMicroelectronics is hopeful that EV-related growth will pick up in the second half of the year. Jean-Marc Chery said: “H2 will be a growth driver for ST for all the components related to electric vehicles, particularly for silicon carbide, and particularly everywhere, in China and also with our main customer,” though he did not specify the customer.

The company’s revised outlook on revenue follows an earlier cut in April. In the second quarter, STMicroelectronics reported revenues of $3.23 billion, a decline of 25.3 percent, with a gross margin of 40.1 percent, operating margin of 11.6 percent, and net income of $353 million or $0.38 diluted earnings per share.

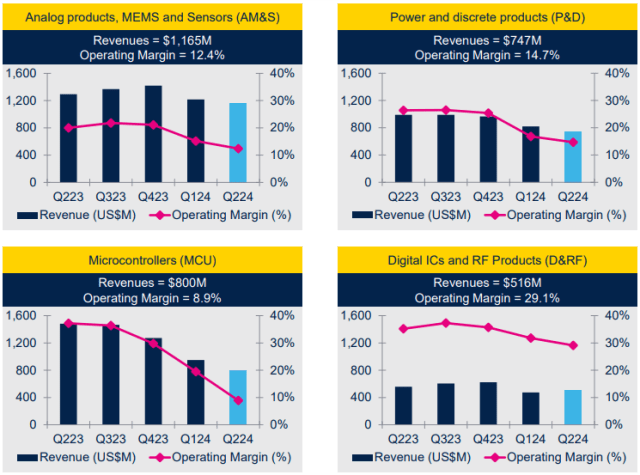

Segment-wise, the company generated $1.165 billion (down 10 percent) from Analog products, MEMS and Sensors (AM&S); $747 million (down 24.4 percent) from Power and discrete products (P&D); $800 million (down 46 percent) from Microcontrollers (MCU); and $516 million (down 7.6 percent) from Digital ICs and RF Products (D&RF).

Sales distribution by sector revealed 46 percent from Automotive, 20 percent from Industrial, 20 percent from Personal Electronics, and 14 percent from Communications Equipment and Computer Peripherals (CECP). Sales in the Industrial sector declined by over 50 percent, Automotive by around 15 percent, and Personal Electronics by about 6 percent, while Communications Equipment and Computer Peripherals (CECP) saw a 2 percent increase.

Geographically, STMicroelectronics derived 58 percent of its sales from the Asia Pacific region, 26 percent from EMEA, and 16 percent from the Americas.

In terms of capital expenditure, the company spent $528 million in the second quarter, down from $1.07 billion in the same quarter last year.

Manufacturing Expansion

In May, STMicroelectronics announced plans to construct a new high-volume 200mm silicon carbide manufacturing facility in Catania, Italy, aimed at producing power devices and modules. This facility, as part of a $5 billion euro investment, will handle both device manufacturing and testing and packaging. Additionally, the company announced an expansion of its 150mm silicon carbide substrate wafers supply agreement with SiCrystal.

Baburajan Kizhakedath