STMicroelectronics has reported first-quarter revenues of $3.47 billion (down 18.4 percent), gross margin of 41.7 percent, operating margin of 15.9 percent, and net income of $513 million (down 50.9 percent).

“Q1 revenues and gross margin both came in below the midpoint of our business outlook range, driven by lower revenues in Automotive and Industrial, partially offset by higher revenues in Personal Electronics,” Jean-Marc Chery, ST President & CEO, said in its earnings report.

“Q1 revenues and gross margin both came in below the midpoint of our business outlook range, driven by lower revenues in Automotive and Industrial, partially offset by higher revenues in Personal Electronics,” Jean-Marc Chery, ST President & CEO, said in its earnings report.

STMicroelectronics is targeting revenues of $3.2 billion in Q2, decreasing year-over-year by 26 percent and decreasing sequentially by 7.6 percent; with gross margin of about 40 percent.

STMicroelectronics is targeting FY24 revenues of $14 billion to $15 billion with gross margin in the low 40’s. Its previous forecast range was $15.9 billion to $16.9 billion. The substantial reduction in revenue target is due to decrease in spending by automotive clients.

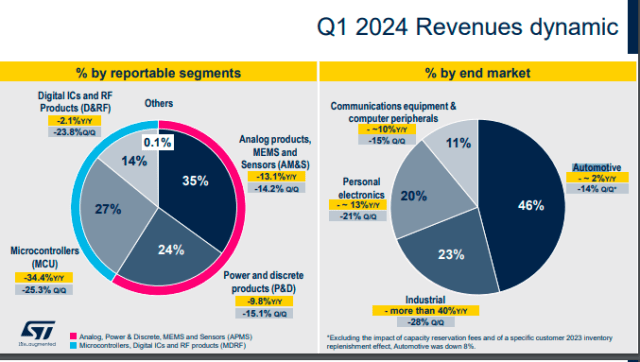

STMicroelectronics has generated 46 percent of its sales revenue from Automotive clients against 23 percent from industrial, 20 percent from personal electronics, and 11 percent from communications equipment and personal computer clients during the first-quarter of 2024.

Some of the clients of STMicroelectronics include Tesla and Apple. Apple’s IPhone shipments fell 19 percent in China, the world’s biggest smartphone market, in the first quarter. EV maker Tesla reported a 8.7 percent drop in its first-quarter revenue to $21.3 billion due to slowing demand and competition worldwide in electrical vehicles.

STMicroelectronics aims to maintain Capex plan for FY24 at about $2.5 billion focusing on its strategic manufacturing initiatives.

Analog products, MEMS and Sensors (AM&S) revenue fell 13.1 percent mainly due to a decrease in MEMS and Imaging.

Power and Discrete products (P&D) revenue dropped 9.8 percent mainly due to a decrease in Discrete.

Microcontrollers (MCU) revenue fell 34.4 percent mainly due to a decrease in GP MCU.

Digital ICs and RF products (D&RF) revenue dipped 2.1 percent due to a decrease in ADAS more than offsetting an increase in RF Communications.