In a recent report by TrendForce, the global DRAM industry has experienced a significant turnaround in the second quarter, with a remarkable increase in shipments and revenues.

The surge in demand for AI servers has played a pivotal role in driving growth, particularly in the High-Bandwidth Memory (HBM) sector. Coupled with a substantial inventory buildup for DDR5 on the client side, all three major DRAM suppliers witnessed a notable boost in their shipment figures.

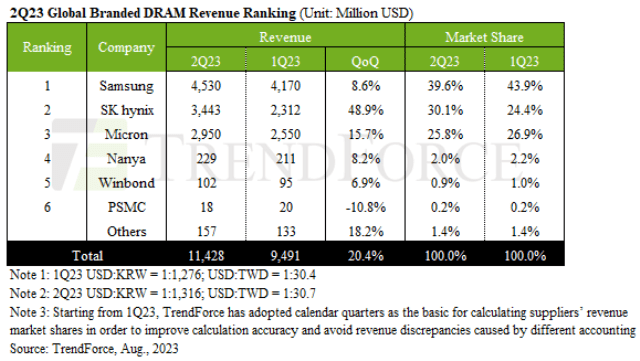

The second quarter’s revenues for the DRAM industry reached a noteworthy milestone of approximately US$11.43 billion, indicating a substantial 20.4 percent quarter-on-quarter (QOQ) increase. This marked a crucial reversal after a persistent decline that lasted for three consecutive quarters.

Among the prominent suppliers, SK Hynix stood out with an impressive quarterly growth rate of over 35 percent in shipments. The company’s shipments of DDR5 and HBM, both commanding higher average selling prices (ASPs), experienced substantial growth. As a result, SK Hynix’s ASP exhibited a counter-cyclical increase of 7–9 percent, effectively propelling its Q2 revenue to soar by nearly 50 percent. With a reported revenue of US$3.44 billion, SK Hynix secured the second-highest position in the industry, firmly driving the sector’s growth.

Samsung, while dealing with limited DDR5 shipments due to its ongoing 1Ynm process, managed to navigate a slight increase in shipments. This was attributed to inventory buildup by module houses and heightened demand for AI server setups. Despite a minor drop in ASP by around 7–9 percent, Samsung reported an 8.6 percent QoQ increase in Q2 revenue, amounting to US$4.53 billion. This resilient performance enabled Samsung to retain its top position in the DRAM market.

Micron, ranking third, had a strong presence in the DDR5 market, contributing to stable ASP figures. Bolstered by these shipments, the company’s revenue surged to approximately US$2.95 billion, reflecting a healthy quarterly growth rate of 15.7 percent. Both Samsung and Micron observed a marginal decline in their market shares.

Although the industry is witnessing a recovery in terms of shipments and revenues, suppliers are still grappling with negative operating profit margins due to the persistently declining contract prices for various products. Notably, Samsung managed to improve its operating margin from -24 percent to -9 percent in Q2. SK Hynix achieved a significant milestone by concurrently growing its revenue and ASP, consequently narrowing its operating profit margin from -50 percent to -2 percent. Micron’s operating profit margin also saw a slight improvement, moving from -55.4 percent to -36 percent.

TrendForce predicts continued growth for the DRAM industry in the third quarter, driven by a reduction in production and a stabilizing trend in contract prices. This reduced inclination to drop prices suggests a more stable market outlook, curbing the losses incurred from inventory price drops. Consequently, operating profit margins are expected to transition from losses to gains.

In a separate analysis, Nanya’s shipments, which had been declining for over four consecutive quarters, experienced a much-needed boost due to increased TV orders in the second quarter. As a result, the company’s revenue saw a commendable rise of approximately 8.2 percent. Meanwhile, Winbond’s revenue for the same period grew by 6.9 percent, largely attributed to the release of tenders in China and the enhanced capacity from the KH factory. This additional flexibility in pricing contributed to an increased order volume.

However, PSMC, primarily reliant on revenue from in-house produced consumer DRAM products (excluding DRAM foundry services), faced challenges stemming from subdued demand and less competitive pricing. As a consequence, the company reported a decline of around 10.8 percent in its DRAM revenue. This sets PSMC apart as the sole supplier witnessing a decline in this quarter. Taking into account DRAM foundry revenue, the decline stands at 7.8 percent, underscoring the unique challenges faced by different players in the evolving DRAM landscape.