A two-year legal dispute between Arm Holdings and Qualcomm threatens to disrupt the launch of a new generation of AI-powered personal computers, Reuters news report said.

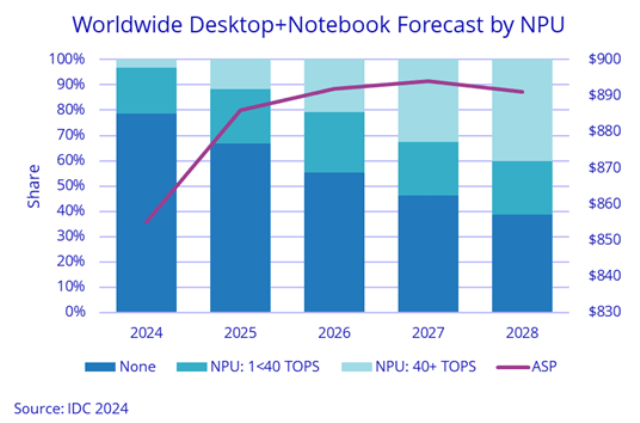

The above chart from research firm IDC indicates the worldwide growth on AI-enabled personal computers and the growth in average selling price of PCs between 2024 and 2028.

At last week’s Computex trade show in Taipei, executives from Microsoft, Asus, and Acer joined Qualcomm CEO Cristiano Amon on stage to promote AI-powered PCs.

Despite the enthusiastic presentations, the main topic of conversation among attendees was the ongoing contract dispute between Arm Holdings and Qualcomm. The conflict could potentially halt the shipment of these new PCs, which are expected to generate billions for Microsoft and its partners.

Initial projections suggest Microsoft aims to capture around 5 percent of the market for Arm-based laptops by year’s end, equating to sales of 1 to 2 million units. Nearly two dozen models from brands including Microsoft, Dell, and Samsung are slated for release on June 18. However, a legal victory for Arm could force Qualcomm and its approximately 20 partners, including Microsoft, to suspend shipments of the new laptops.

“It’s definitely a real risk,” said Doug O’Laughlin, founder of chip financial analysis firm Fabricated Knowledge. “The more successful the laptops are, the more fees Arm can eventually collect.”

The lawsuit, filed by Arm in 2022, centers on Qualcomm’s failure to negotiate a new license after acquiring Nuvia, a company founded by former Apple chip engineers, for $1.4 billion in 2021. Nuvia had intended to design server chips using Arm licenses, but after the acquisition, Qualcomm redirected the team to develop a laptop processor, now featured in Microsoft’s AI PC, Copilot+.

Arm claims the design for Microsoft’s Copilot+ laptops is a direct descendant of Nuvia’s chip and has canceled the license for these chips. “Arm’s claim against Qualcomm and Nuvia is about protecting the Arm ecosystem and partners who rely on our IP and innovative designs, and enforcing Qualcomm’s contractual obligation to destroy and stop using the Nuvia designs derived from Arm technology,” an Arm spokesperson said.

Qualcomm contends that its broad license for Arm technology covers its PC chips. “Arm’s complaint ignores the fact that Qualcomm has broad, well-established license rights covering its custom-designed CPUs, and we are confident those rights will be affirmed,” said Ann Chaplin, Qualcomm’s general counsel, in a 2022 statement.

Adding to the complexity is the expiration of Qualcomm’s exclusive deal to supply laptop builders with its chips this year, opening the market to competitors like Nvidia and Advanced Micro Devices (AMD), both of which are developing their own chips.

Despite the tension between Arm and Qualcomm, some investors and analysts believe a settlement will be reached before the trial, scheduled to begin in federal court in Delaware in December. “There is a degree of absurdity in Arm suing its second-biggest customer and Qualcomm being sued by its largest supplier,” said Jay Goldberg, CEO of D2D Advisory, a finance and strategy consulting firm.