Yearly shipments of cellular IoT modules fell to 423 million units in 2023, marking a 3 percent year-on-year decrease.

Correspondingly, annual revenues for cellular IoT modules declined by 9 percent to $5.9 billion. The top five cellular module vendors – Quectel, Fibocom, Telit Cinterion, Semtech, and u-blox – accounted for 72 percent of market revenues.

Correspondingly, annual revenues for cellular IoT modules declined by 9 percent to $5.9 billion. The top five cellular module vendors – Quectel, Fibocom, Telit Cinterion, Semtech, and u-blox – accounted for 72 percent of market revenues.

Leading the supply of cellular IoT chipsets are Qualcomm, UNISOC, and ASR Microelectronics, with other key providers including Eigencomm, MediaTek, Sony, and Xinyi Information Technology.

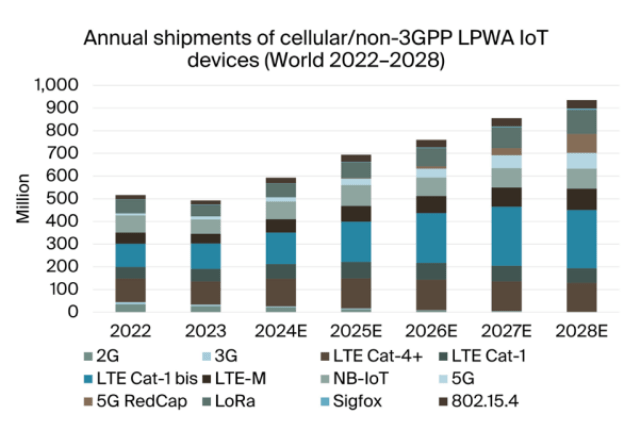

The cellular IoT landscape is dominated by 4G LTE technologies optimized for IoT, such as LTE Cat-1/LTE Cat-1 bis, NB-IoT, and LTE-M, which are replacing older 2G and 3G technologies in the low to mid-market segments.

Higher-speed IoT devices still primarily use LTE Cat-4 and higher Cat LTE-A technologies but are gradually transitioning to 5G as network coverage and pricing improve. Currently, 5G IoT devices are mainly found in fixed wireless access customer premises equipment (FWA CPEs), IoT routers, and advanced automotive applications. 5G RedCap modules are becoming available, promising a wider array of 5G IoT use cases, though their adoption is expected to be slow in the short term due to cost and 5G SA network coverage requirements.

Despite the recent downturn, the cellular IoT module market is forecasted to grow at a compound annual growth rate (CAGR) of 13.2 percent, reaching 786 million units by 2028, according to Berg Insight.

LoRa and Sigfox Technologies Gaining Momentum

LoRa technology is increasingly recognized as a global connectivity platform for IoT devices. As of early 2024, the installed base of LoRa end nodes reached 350 million, with approximately 20 percent connected to public networks.

According to Berg Insight, the LoRa and LoRaWAN ecosystems will continue to be dominated by private networks, with significant applications in smart gas and water metering due to LoRa’s low power consumption, which supports long-life battery operations.

LoRa is also gaining traction in urban and local area IoT deployments for smart sensors and tracking devices in cities, industrial plants, and commercial buildings. The smart home sector is expected to become a major application area, driven by Amazon’s Sidewalk network in the U.S. Berg Insight estimates that 50 million LoRa devices were shipped in 2023, with annual shipments projected to grow at a CAGR of 16.2 percent, reaching 106 million units by 2028.

Sigfox, under the management of Singapore-based UnaBiz since 2022, saw its installed base of devices grow to 12.5 million by the end of 2023, a 10 percent increase from the previous year. The critical test for Sigfox will be its reception in the asset tracking segment, alongside promising applications in various industries’ sensor solutions. Berg Insight forecasts that Sigfox device shipments will grow at a remarkable CAGR of 33.6 percent, from 1.6 million units in 2023 to 6.6 million units by 2028.