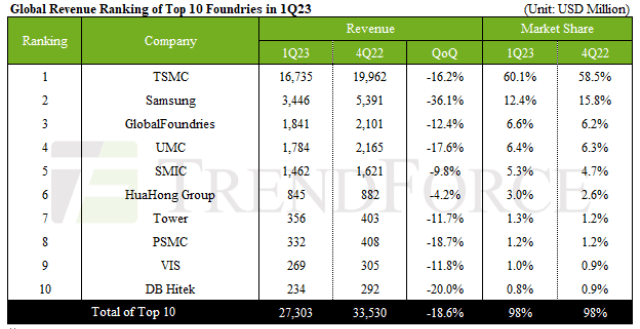

The revenue of the top 10 global foundries experienced an 18.6 percent decline quarter-over-quarter in the first quarter of 2023, amounting to $27.3 billion.

During this period, GlobalFoundries surpassed UMC and secured the third position, while Tower Semiconductor surpassed PSMC and VIS, claiming the seventh spot.

During this period, GlobalFoundries surpassed UMC and secured the third position, while Tower Semiconductor surpassed PSMC and VIS, claiming the seventh spot.

TSMC reported a revenue of $16.74 billion, registering a 16.2 percent QoQ drop. This decline was primarily attributed to weakened demand for mainstream applications like laptops and smartphones, resulting in lower utilization rates and revenue for their 7/6 nm and 5/4 nm processes, which fell by over 20 percent and 17 percent, respectively.

Samsung posted a revenue of $3.45 billion, reflecting a significant 36.1 percent decrease. The decline can be attributed to decreased capacity utilization rates for both 8-inch and 12-inch wafers.

GlobalFoundries reported a Q1 revenue of $1.84 billion, marking a 12.4 percent QoQ decrease. Despite this decline, GlobalFoundries has maintained stable operations since the market turnaround in the second half of the previous year, benefiting from strong demand in sectors such as automotive, defense, industrial equipment, and government applications in the US.

Looking ahead, GlobalFoundries is expected to continue benefiting from stable orders in the industrial IoT, aerospace and defense, and automotive sectors, which will support capacity utilization and maintain revenue levels similar to those in the first quarter.

UMC experienced a Q1 revenue decline of 17.6 percent, totaling approximately $1.78 billion. Notably, this decline was particularly significant for their 28/22 nm and 40 nm processes, both of which decreased by at least 20 percent.

For the second quarter of 2023, UMC’s capacity utilization rate for 8-inch wafers is projected to fall below 60 percent due to reduced customer orders for PMIC and MCU. However, their 12-inch capacity utilization rate will benefit from urgent orders for 28/22 nm products such as Tcon and TV SoC, resulting in an estimated 80 percent utilization rate.

UMC’s revenue is expected to remain steady or experience a slight increase in the next quarter due to the stable ASP (average selling price).

SMIC posted $1.46 billion in revenue for the first quarter, reflecting a 9.8 percent QoQ decline. Revenue from 8-inch wafers saw a significant drop of nearly 30 percent, while revenue from 12-inch wafers experienced a slight increase of 1-2 percent, mainly driven by a diverse product portfolio and domestic demand in China.

Moving forward, SMIC is expected to benefit from the recovery of orders for specific products like Driver IC and Nor Flash, along with continued support from Chinese demand. This improvement is anticipated to lead to growth in shipment volume and capacity utilization rate, resulting in revenue growth.

According to TrendForce, the top 10 foundries are projected to experience a further decline in revenue during the second quarter, albeit at a slower pace compared to the first quarter. While supply chains are expected to gradually build up inventory in response to the anticipated peak season demand in the latter half of the year, the current accumulation of inventory and sluggish consumption has resulted in reduced enthusiasm among customers for stockpiling.

As a result, the overall production cycle of foundries in the second quarter is expected to be more relaxed, with limited growth in capacity utilization rates. Notable increases in utilization rates are anticipated only in the case of sporadic rush orders for products such as TV System-on-Chip (SoC), WiFi 6/6E, and Touch and Display Driver Integration (TDDI).