Viasat has reported its financial result and main achievements during the April-June quarter of 2024.

Viasat’s revenue increased 44 percent to $1.1 billion driven by the contribution from the recently-acquired Inmarsat.

Viasat posted net loss of $33 million for Q1 FY2025 as compared to the net loss of $77 million in Q1 FY2024 primarily due to improved operating performance.

Viasat said capital expenditures declined 20 percent to $301 million. Combined capital expenditures decreased 33 percent primarily due to lower satellite expenditures, customer premise equipment, and general infrastructure costs. Sequentially, capital expenditures decreased 20 percent primarily due to lower satellite expenditures and general infrastructure costs.

Viasat received approximately 75 percent of our anticipated $770 million of insurance claims by end of Q1 FY2025.

Communication Services revenue increased 48 percent to $827 million driven by the Inmarsat acquisition.

Viasat has generated sales revenue of $257 million from Aviation, $184 million from Government Satcom, $124 million from Maritime, $202 million from Fixed Services and Others.

U.S. fixed broadband ended the quarter with approximately 257,000 subscribers and $115 average revenue per user.

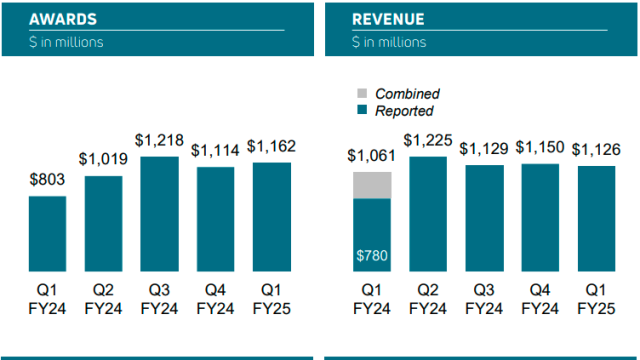

Communication Services awards increased 60 percent to $811 million driven by the Inmarsat acquisition and aviation.

Defense and Advanced Technologies revenue rose 37 percent to $300 million. Recurring contributions from certain licensing agreements within advanced technologies and other (AT&O) contributed to the largest component of the product revenue increase. Tactical networking products revenue was $71 million. Information security and cyber defense products slightly declined to $56 million. Space and Mission Sys revenue was $73 million.

Defense and Advanced Technologies awards increased 18 percent to $351 million due to demand for tactical networking products, antenna systems solutions and recurring contributions from certain licensing agreements.

Backlog was $712 million, a decrease of 22 percent reflecting fulfillment of encryption products and antenna systems programs, and an increase of 9 percent sequentially driven by strong wins in Q1 FY2025.

Baburajan Kizhakedath