Success in Africa’s entertainment market hinges on effective streaming pricing strategies. Platforms can thrive by adopting flexible pricing, adaptable subscription models, and forging partnerships. Tailoring offerings to local needs is crucial, as is leveraging the roles of telecommunications, financial services, and e-commerce sectors, BB Media, a part of Fabric Data, said in a report.

The African streaming market demands pricing strategies that align with local economic conditions. Currently, 97 percent of streaming services in Africa operate on subscription-based models, while only 4 percent offer ad-supported subscriptions — a stark contrast to global platforms like Netflix, Disney+, and Prime Video, which have adopted ad-supported plans to attract a broader audience.

For example, Netflix’s ad-supported option is about 37 percent cheaper than its ad-free version, a strategy that could be particularly impactful in South Africa, where financial difficulties are a leading cause of subscription cancellations. Many users consider platforms too expensive and reduce spending during economic downturns, so introducing lower-priced, ad-supported options without reducing content quality could help retain and grow user bases.

Furthermore, with 75 percent of South African users consuming content on smartphones, mobile-specific plans have gained traction. These affordable options cater to users with limited connectivity and lower data budgets. Platforms such as Netflix, Showmax, and Shahid have launched mobile plans in countries like Guinea, Liberia, and Gambia, while Disney+ has introduced mobile plans in South Africa, all aligning with regional consumption habits and financial realities.

In price-sensitive markets like South Africa, promotions play a vital role in retaining and acquiring users. At the end of 2024, Disney+ faced a 5 percent churn rate in the country, with 34 percent of users citing high costs and 38 percent pointing to financial difficulties as reasons for canceling their subscriptions. To address this, Disney+ launched a limited-time promotional offer allowing users to subscribe for ZAR 49 (USD 2.64) for four months, available from March 13th to 31st. This approach targets both new users and those who had unsubscribed due to affordability concerns, especially since the average subscription price is about USD 7.

Promotional strategies remain underused in Africa, with only 38 percent of streaming platforms offering incentives like free trials or temporary discounts, despite their potential to attract new users. However, such promotions don’t always secure long-term retention.

Apple TV+ illustrates this challenge; despite offering up to three months free with Apple devices, a seven-day trial, and bundling with the Apple Music for Students plan, it still reports a high churn rate of 8 percent. In April 2025, Apple TV+ introduced a new global promotion in African markets, including South Africa, allowing users to subscribe for ZAR 29.99 (USD 1.60) for three months. This move aims to increase accessibility and reduce churn in price-sensitive regions. The platform’s experience highlights that competitive pricing alone is not enough — factors such as content variety, user experience, and interface quality are also critical to retaining subscribers.

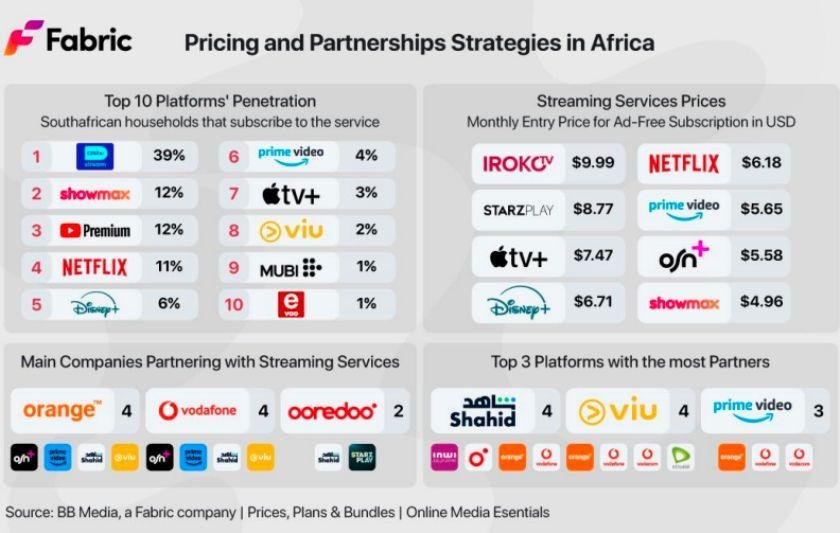

Despite the availability of mobile plans among African streaming platforms, 7 percent have established partnerships with telecommunications companies — significantly lower than in regions like UCAN (39 percent) and LATAM (32 percent). This highlights untapped potential for integrating streaming subscriptions with mobile data plans, which can improve accessibility and increase perceived value.

Telecom operators such as Orange, Vodafone, and Ooredoo are beginning to explore this model, with MTN in South Africa offering a Disney+ bundle that includes 500 MB of data as an example of its viability. Another effective strategy is bundling platforms at reduced prices, already seen in UCAN and LATAM through offerings like the Disney+ and Max bundle in the U.S., or Prime Video’s integration of multiple services. Applying similar bundling strategies in Africa — through partnerships between regional and international platforms — could offer more affordable combined subscriptions, enrich content libraries with both local and global content, and attract users who are currently priced out of the market.

The use of standardized USD pricing across much of Sub-Saharan Africa limits streaming accessibility by reducing perceived affordability and requiring international payment methods, which are often unavailable to many users. While platforms have localized pricing in countries like South Africa, Kenya, and Nigeria, a uniform approach persists elsewhere.

Streaming services like Netflix, Prime Video, and Crunchyroll have adopted localized pricing models to better reflect regional economic conditions. Localization of both pricing and payment systems is essential not just for market growth but for advancing digital equity. User-focused strategies that include tailored mobile-only plans, free trials, and regional promotions are already in use by platforms like Disney+, Netflix, Showmax, Prime Video, and Apple TV+. Collaborations with local partners are also crucial; for example, Netflix’s partnership with Vodacom in South Africa enables mobile billing, helping to lower access barriers and align more closely with local user needs.

Baburajan Kizhakedath