GlobalData, a prominent analytics firm, forecasts substantial growth in Japan’s Subscription Video on Demand (SVoD) sector.

Projections indicate a robust surge in revenue, expected to reach $6 billion by 2027, marking a significant increase from $3.5 billion in 2022. This growth trajectory, with a compound annual growth rate (CAGR) of 10.1 percent, stems from various factors driving the SVoD landscape in the country.

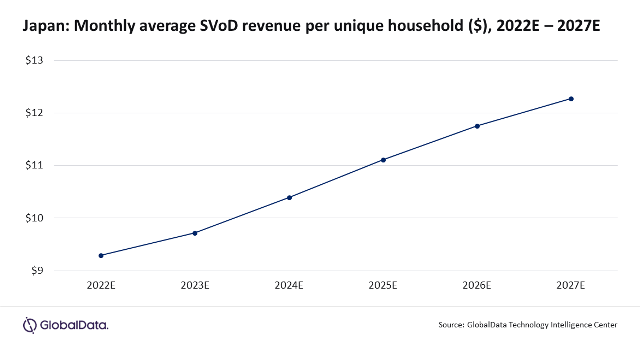

The report highlights the pivotal role of SVoD subscriptions and the burgeoning count of unique SVoD households in propelling this growth. Additionally, there’s a steady upward trend in the average monthly revenue per unique SVoD household, expected to rise from $9.29 in 2022 to $12.28 in 2027. Kantipudi Pradeepthi, a Telecom Analyst at GlobalData, attributes this surge to the increasing appetite for premium video content among consumers in Japan.

The surge in SVoD subscriptions over the forecast period is anticipated to be buoyed by the escalating household penetration of fixed broadband services, particularly fiber-to-the-home/building (FTTH/B) services. This phenomenon is accompanied by a consumer shift from conventional pay-TV services to Over-the-Top (OTT) video platforms.

Amazon Prime Video emerges as the frontrunner in Japan’s SVoD market, poised to hold the largest share of SVoD subscriptions in the coming years. Following closely behind is Netflix. Pradeepthi outlines Amazon’s success, attributing it to a blend of factors including a bundled subscription with their e-commerce service, competitive pricing, and the availability of localized Japanese content along with licensed anime, American films, and television shows.

As Japan’s SVoD landscape continues to evolve, Amazon’s comprehensive offering and strategic content partnerships position it favorably to maintain its dominance in the market. This outlook underscores the growing significance of SVoD platforms in catering to evolving consumer preferences and content consumption habits in Japan.