The DOJ’s proposal for Google to divest its Chrome browser business represents a critical juncture for Alphabet and the tech industry as a whole, according to GlobalData analyst Murthy Grandhi. This potential action strikes at the heart of Alphabet’s business strategy, where Chrome serves as a vital gateway to its ecosystem.

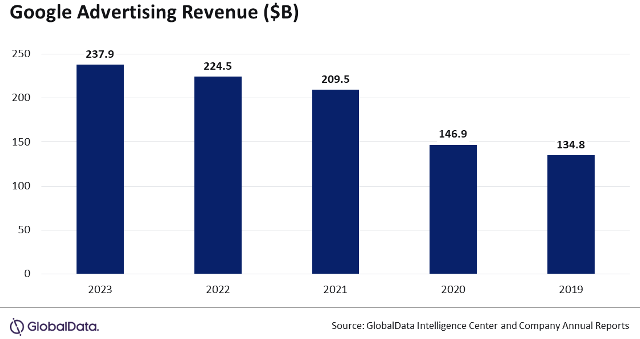

With Chrome commanding nearly two-thirds of the global browser market, a forced sale would disrupt the core mechanisms that drive Alphabet’s massive advertising revenues, which totaled $192 billion in the first nine months of 2024.

Chrome is more than just a browser; it links users to key services such as Gmail, YouTube, and Google Drive. Losing Chrome would sever a major traffic conduit to Alphabet’s platforms, impacting ad revenue and diminishing the data pool that feeds its advertising algorithms.

Alphabet could pivot to accelerate growth in other areas, such as artificial intelligence and cloud computing, leveraging its significant R&D investments, which accounted for 14.2 percent of its $253.5 billion revenue in 2024. This might push the company to innovate faster in emerging markets and technologies, helping it reduce reliance on its advertising-centric model.

Alphabet’s strong financial health, including $19.9 billion in cash reserves as of September 2024, positions it to weather regulatory pressures. Its diverse portfolio in hardware, autonomous driving, and other ventures offers additional buffers against potential revenue losses.

The DOJ’s proposal could reshape the tech landscape, creating a more competitive browser market. It might also inspire similar actions against other dominant tech players, increasing regulatory scrutiny across the sector.

A more level playing field could spur innovation and provide consumers with a broader range of options in browsers and related services.

While regulatory measures increase operational costs, established giants like Alphabet are better equipped to adapt compared to smaller rivals, potentially consolidating their market dominance in other areas.

For Alphabet, the near-term could bring market volatility as investors react to regulatory developments. However, in the long term, the company’s adaptability and strategic pivots will be key to maintaining resilience and investor confidence. The DOJ’s actions may not only redefine Alphabet’s future but could also mark a transformative moment for the broader technology industry, signaling a shift toward stricter antitrust enforcement.

The U.S. Department of Justice’s (DOJ) proposed forced sale of Google’s Chrome browser faces significant legal and practical challenges, raising doubts about the feasibility of such an extreme antitrust remedy, Reuters news report said.

While the proposal seeks to curb Google’s dominance in the online search market, it is likely to encounter formidable hurdles rooted in legal precedent, practical implementation, and broader geopolitical considerations.

Courts traditionally require a direct link between a remedy and the alleged antitrust violation. Critics argue that divesting Chrome may not adequately address Google’s search monopoly because Chrome is not the sole driver of its dominance. The browser can operate with non-Google search engines, weakening the argument that its divestiture would resolve the core antitrust concerns.

The DOJ’s attempt to break up Microsoft in the early 2000s, based on similar allegations of monopolistic practices, was ultimately overturned on appeal. That case resulted in a settlement rather than the drastic measures initially sought. This precedent underscores the difficulty of securing judicial approval for extreme remedies like divestiture.

Legal proceedings in antitrust cases often extend over years. Alphabet is expected to challenge the DOJ’s actions vigorously, leveraging both its substantial resources and previous judicial outcomes to resist divestiture.

Chrome’s integration into Google’s broader ecosystem is what makes it valuable. As a standalone entity, its worth diminishes significantly because it loses the synergy with Google’s advertising and search businesses. This undermines its appeal to potential buyers.

Any potential buyer for Chrome would need DOJ approval. Ensuring the buyer has the capability and independence to foster competition in the browser market adds another layer of complexity to the process.

Critics argue that selling Chrome does not directly address Google’s monopoly in search. The DOJ would still need to tackle Google’s search agreements with partners like Apple, which are more critical to its search dominance than Chrome’s role.

A forced sale could impact the competitiveness of the U.S. tech industry, particularly as it faces intensifying global competition, especially from China in areas like AI. Former President Trump has signaled reluctance to harm major U.S. tech companies in ways that might weaken their position globally.

Google argues that such measures would harm consumers and developers by reducing funding for initiatives like Mozilla and diminishing privacy protections. These claims, if substantiated, could sway public opinion and the courts.

Proposals like banning Google from offering incentives for preferential treatment of its search engine or requiring it to license search data to rivals might prove more palatable to courts. These measures could promote competition without necessitating the outright sale of Chrome.