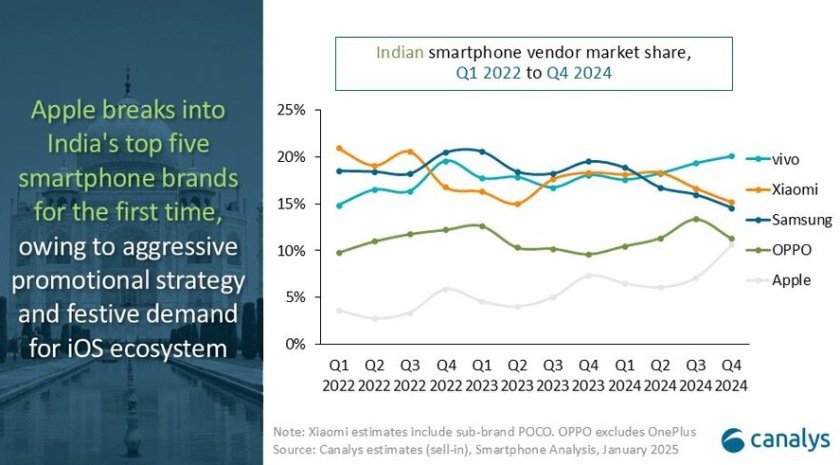

Apple achieved a significant milestone in India by breaking into the top five smartphone brands for the first time in Q4 2024, shipping 4.0 million units and benefiting from aggressive promotions and strong festive demand.

Its success is attributed to strategies focused on driving upgrades, strengthening its ecosystem, and enhancing affordability through programs like the “Buyback Program” and “iPhone for Life Program,” which offer interest-free EMI plans. These initiatives, combined with cashback offers and discounts, have made iPhones more accessible, particularly during competitors’ flagship launches and festive seasons.

Apple’s growth is further supported by its focus on the ultra-premium segment, where competition has intensified. The company has strategically targeted Pro series upgrades for existing customers, leveraging price adjustments from local production.

Its expansion into lower-tier cities aims to attract new iOS users, capitalizing on the high aspirational value of iPhones. Additionally, channel-driven strategies such as trade-in offers, extended warranties, and zero prepayment schemes have effectively driven demand for higher-value models.

The strong performance of Apple’s previous-generation models, combined with sustained demand for the latest iPhone 15 series, underscores its growing appeal in India’s premium segment, said Sanyam Chaurasia, Senior Analyst at Canalys.

Moving forward, Apple’s plans to boost ecosystem demand, expand its market reach, and invest in consumer-focused affordability programs position it as a formidable player in the evolving Indian smartphone industry.

Vivo has retained its top position with 7.5 million units and a 20 percent market share, followed by Xiaomi with 5.7 million units and Samsung with 5.4 million units. OPPO and Apple completed the top five.

Baburajan Kizhakedath