The latest Canalys report has revealed the size of Indian smartphone market in 2024 and the trends to watch in 2025.

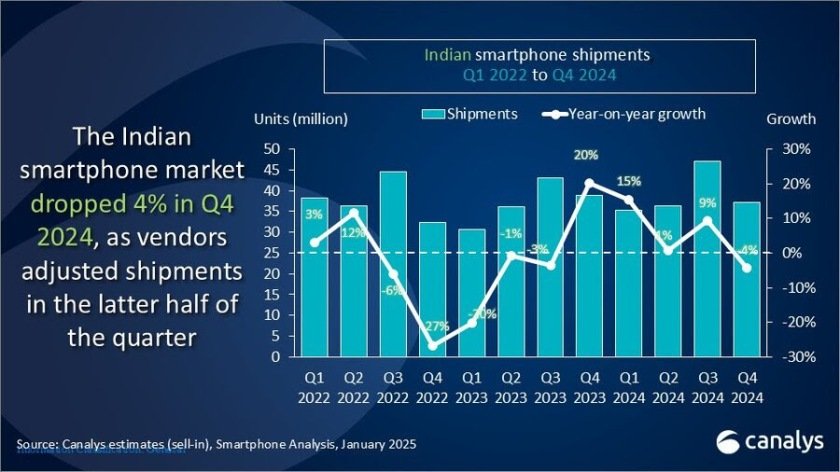

Indian smartphone shipments declined by 4 percent to 37.2 million units in Q4 2024 as vendors adjusted inventory after the festive season.

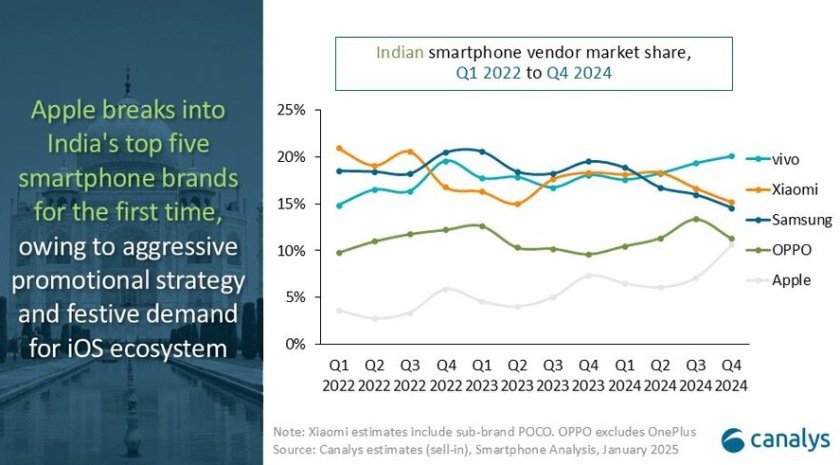

Vivo (7.5 million), Xiaomi (5.7 million), Samsung (5.4 million), OPPO (4.2 million), Apple (4.2 million) are the leading smartphone brands in Q4 2024.

Vivo (29.5 million), Xiaomi (26.6 million), Samsung (25.7 million), OPPO (18.3 million), Realme (16.6 million) are the leading smartphone brands in Q4 2024.

Vivo has retained its top position in Indian smartphone market with 7.5 million units and a 20 percent.

Xiaomi has shipped 5.7 million units.

Samsung shipped 5.4 million units.

OPPO and Apple completed the top five, with Apple reaching fifth place for the first time due to aggressive promotions and strong festive demand.

For the full year, the Indian smartphone market grew 5 percent to 155.9 million units, driven by the pandemic refresh cycle and 5G upgrades. Smartphone brands aggressively launched devices in the first three quarters but faced inventory challenges during the festive season, leading to heavy discounts and extended channel margins to clear stock.

Cautious vendor strategies characterized Q4 as high channel inventories impacted volume growth, though value growth underscored strong premium demand. Vivo maintained momentum through its T3 and Y-series, while OPPO focused on features like design and durability in its K12x, A3, and F27 models. In the premium segment, Samsung’s Galaxy S23 and S23 FE and Apple’s iPhone 15 showed resilience despite overall shipment declines.

Outlook

Canalys forecasts modest single-digit growth for 2025 as the pandemic replacement cycle nears its end. The US$100 to US$200 price range will see strong demand due to 5G adoption, while the sub-US$100 segment faces challenges from macroeconomic pressures, competition from 4G feature phones, and a growing second-hand market.

Premiumization trends persist but face headwinds, including rising interest in refurbished devices and longer device retention by urban consumers. Brands must invest in consumer education, develop AI-driven localized use cases, and optimize retail channels to sustain premium segment growth, Sanyam Chaurasia, Senior Analyst at Canalys, said.

Baburajan Kizhakedath