5G and LTE-Advanced are set to drive long-term growth in macrocell mobile backhaul market, says Richard Webb, research director, mobile backhaul and small cells, IHS Markit.

Huawei, Ericsson, NEC, Nokia and Ceragon were the revenue market share leaders in the mobile backhaul gear in the first half of 2016.

Macrocell mobile backhaul equipment revenue increased 5 percent in 2015 from 2014. The global mobile backhaul equipment revenue is expected to be nearly flat in 2016, declining just 1 percent year-over-year, to $8.3 billion, says IHS Markit.

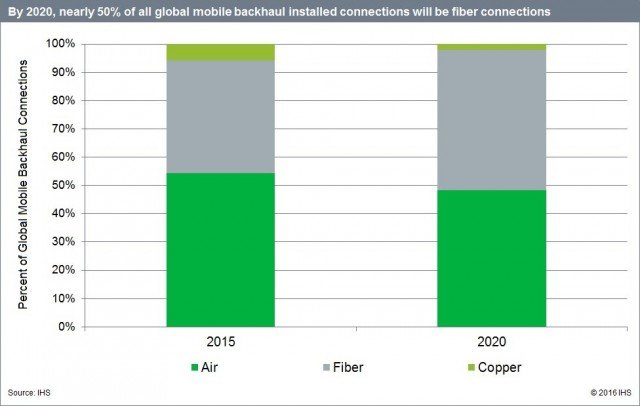

The report said that slow shift toward fiber connections and the use of IP edge routers for mobile backhaul continues.

Microwave will be a vital, long-term contributor to the backhaul market; millimeter wave is anticipated to be very relevant in the 5G era.

Demand remains solid from LTE deployments, outlying 3G network expansion and backhaul enhancements for existing connections; however, increasing pressure on equipment pricing continues to inhibit revenue growth.

IHS Markit said global mobile backhaul equipment revenue will be $8.76 billion in 2020. IP edge routers shipping to the mobile backhaul market will gain traction as operators prepare their networks for 5G expansion with backhaul capacity upgrades.

Looking at backhaul technologies, fiber has been nibbling away at microwave’s share of revenue for a few years now — and the slow shift to a fiber-biased market is evident through our forecast period (2015–2020).

Microwave radio remains a significant part of the macrocell backhaul picture. Demand for increasing backhaul bandwidth will result in a boost for microwave — especially millimeter wave — that will contribute to revenue growth through the mid-to-long term.

The report said the small cell backhaul opportunity plays a part in this, as we expect many small cells to be aggregated to a macrocell site, driving increased macro backhaul capacity.