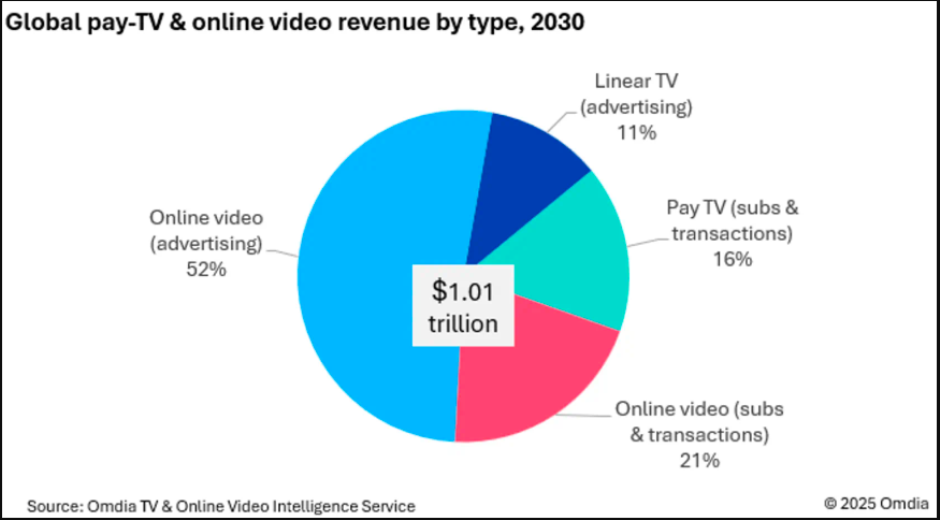

The global TV and online video industry is on track to generate $1 trillion in annual revenue by 2030, driven by the rise of streaming services and digital advertising. The projection comes from two new reports by Omdia – Global Streaming: Key Trends 2025–30 and Pay TV & Online Video: Global – which highlight the steady transformation of global viewing habits and monetization models.

Streaming Fuels Industry Growth

While traditional pay TV remains largely flat, online video continues to propel industry expansion. Omdia forecasts that global video streaming revenue will reach $214.6 billion in 2025, growing at an annual rate of 12.8 percent. Subscription-based video-on-demand (SVOD) will remain the dominant force, accounting for nearly 77 percent of total streaming revenue.

Advertising is also playing a growing role in the streaming ecosystem. Premium ad-supported services – spanning hybrid SVOD/AVOD, native AVOD, FAST (Free Ad-Supported Streaming TV), and broadcaster-led streaming platforms – are projected to generate $42.1 billion globally in 2025, up 15.6 percent from 2024.

Pay TV Remains a Strong Revenue Contributor

Despite declines in pay TV subscriptions, traditional television will provide substantial revenue for several years.

Adam Thomas, Practice Leader at Omdia, said: “While traditional pay TV is declining, this is happening slowly. Pay TV will continue to contribute substantial revenue for many years. Combined with strong, ongoing growth in online video, this creates a highly positive scenario and leads Omdia to forecast that the two markets together will top $1 trillion in revenue by 2030.”

Streaming Enters a Mature Phase

Tony Gunnarsson, Principal Analyst at Omdia, said that streaming remains primarily a subscription-driven business but is entering a new phase of maturity.

“In 2025, the total number of paid subscriptions continues to grow steadily. But there is a wake-up call ahead: through to 2030, the market will keep expanding but lower annual growth rates are expected for premium streaming, reflecting that streaming has reached mass-market penetration globally,” he said.

The rise of hybrid models – combining subscriptions with advertising – is successful. “It is early days for hybrid video. While streaming stays largely a subscription-focused business for the foreseeable future, the shift to include advertising tiers has paid off handsomely,” Tony Gunnarsson said.

Advertising’s Growing Role in the Streaming Economy

Omdia’s research highlights the growing importance of advertising across both SVOD and broader streaming platforms. By 2030, the combined advertising revenue from the “big five” US streaming services – Netflix, Amazon, Disney, HBO Max, and Paramount – is expected to reach $24.3 billion, accounting for 20 percent of their total combined revenue. This marks a sharp rise from 13 percent in 2025.

Netflix

Netflix is enhancing its investment in gaming and broader monetisation possibilities — signalling a push beyond pure streaming video content. A user-interface refresh is planned that will add a dedicated tab for games.

Amazon Prime Video

Amazon is phasing out its stand-alone free streaming app Freevee, and moving the ad-supported catalogue into Prime Video to simplify the experience. Amazon has increased the ad-load on Prime Video: where ads were previously around 2-3.5 minutes per hour, now the range is 4-6 minutes per hour. In the U.S., Amazon Prime Video will be adding a faith-focused channel from Wonder Projects this fall, Reuters reports.

Disney +

Disney+ is launching content supporting new visual standards: for example, through its partnership with Samsung TVs to support HDR10+ dynamic-contrast streaming. The service will stream the latest volume of the anthology series Star Wars: Visions (Volume 3) from nine different anime studios. Separately, Disney announced that its app integration with Hulu will deepen — though full integration plans were flagged earlier.

HBO Max

HBO Max streaming service has announced an exclusive streaming debut of the feature film WEAPONS on October 24 2025. The parent company, Warner Bros. Discovery, officially reverted the service’s name from “Max” back to “HBO Max” in mid-2025, to leverage the stronger HBO brand identity.

Paramount +

Paramount+ expanded its live sports streaming rights: a deal to stream the UFC in Latin America and Australia from 2026. The service also announced key content moves: for example, a major long-term deal with South Park creators (50 new episodes) and full access to past seasons for the platform globally.

A Dynamic Future for Global Video

The convergence of subscription and ad-supported models positions the global video ecosystem for sustained growth through the next decade. While pay TV’s decline is gradual, the strong momentum in online video and expanding ad opportunities will continue to drive total market value toward the $1 trillion milestone by 2030.

Fasna Shebeer