The rollout of 5G Standalone (SA) networks is gaining strong momentum worldwide, transforming public and private connectivity strategies.

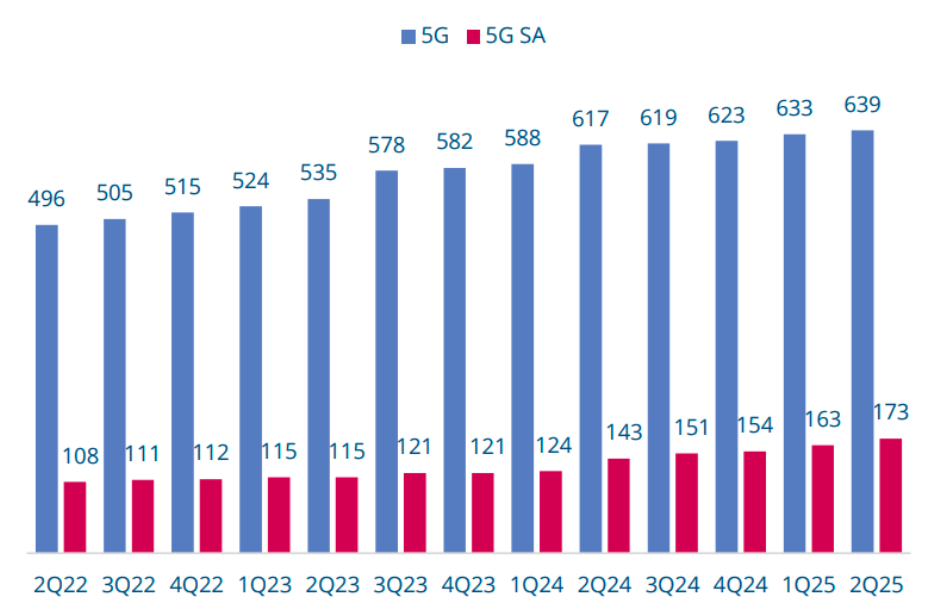

According to the Global mobile Suppliers Association (GSA), 173 operators across 70 countries and territories have already invested in 5G SA through trials, deployments, or announced roadmaps. This represents 27.1 percent of all operators engaged in 5G investments.

How 5G SA Networks Are Being Deployed

5G SA networks can be deployed in multiple ways depending on operator strategies and enterprise needs:

Overlay deployments on existing public non-standalone (NSA) 5G networks.

Greenfield 5G rollouts by public operators without legacy LTE networks.

Private 5G deployments for enterprises, utilities, governments, universities, and other organizations needing secure campus-wide networks.

This flexibility makes 5G SA a crucial enabler for both national mobile coverage and Industry 4.0 digital transformation initiatives.

Recent 5G SA Launches in 2025

Since April 2025, several operators have accelerated their SA roadmaps:

T-Mobile Czechia is deploying a 5G SA network in the Danube Delta region.

Paradise Mobile in Bermuda officially launched 5G SA in July 2025.

Liberty Costa Rica partnered with Ericsson to build its 5G SA network.

In Europe, Orange launched 5G SA services in France and Romania, while Sunrise Communications (Switzerland), Elisa (Estonia), and LMT (Latvia) introduced the technology for the first time in their respective countries.

Regional Momentum in 5G SA Rollouts

Europe, Middle East & Africa (EMEA): Now leads global SA deployments with 36 commercial launches, surpassing the Asia-Pacific region, which had an early head start.

North America: Bermuda’s Paradise Mobile marks a key launch in 2025.

Latin America: 11 operators in six countries are investing in 5G SA.

Africa: Still at an early stage, with only five countries making notable investments.

Overall, 77 operators in 43 markets have launched public 5G SA networks, including two with soft launches. Another 96 operators are actively engaged in trials, planning, or deployment phases.

Private 5G SA Networks: A Parallel Growth Story

Beyond public operators, enterprises are rapidly embracing private 5G SA networks. GSA has tracked 1,772 organizations worldwide deploying or licensed for private LTE/5G mobile networks. Of these, 829 are already using 5G, many built on SA architecture.

Sectors leading adoption include:

Manufacturing and industrial automation

Academic and research institutions

Transportation and aviation

Construction and IT services

Private 5G SA networks are enabling advanced use cases like smart factories, autonomous systems, AI-driven logistics, and campus-wide secure connectivity.

Outlook: Rapid Growth Expected in 2025 and Beyond

With new launches continuing every quarter in 2025, 5G SA is becoming the foundation for next-generation connectivity. Its low-latency, high-reliability, and network slicing capabilities are set to power not only public mobile networks but also enterprise digital transformation worldwide.

The 5G Standalone (SA) device ecosystem is experiencing rapid growth, keeping pace with the expansion of 5G SA networks worldwide. According to the Global mobile Suppliers Association (GSA), as of June 2025, there are 2,437 announced 5G devices with claimed SA support, representing a 27.9 percent increase from 1,906 in June 2024.

Of these, 2,205 devices are commercially available, up 31.5 percent from 1,677 a year earlier, demonstrating strong momentum in device readiness for standalone 5G services.

Steady Growth in 5G SA Device Share

The proportion of 5G SA-capable devices continues to climb:

69.7 percent in September 2024

69.9 percent in December 2024

70.6 percent in March 2025

71.5 percent by June 2025

This steady increase highlights growing manufacturer focus on supporting 5G SA as the default standard, even though many devices still require software upgrades to activate full SA functionality.

Form Factors Driving Adoption

The 5G SA device ecosystem spans a variety of form factors to meet both consumer and enterprise demand:

Phones – The largest segment, with 1,440 announced devices (59.1 percent) and 1,363 commercially available (61.8 percent).

Modules – 243 announced and 197 available, supporting integration into equipment and IoT solutions.

Fixed Wireless Access (FWA) CPE – 237 announced and 183 available, enabling enterprise and home broadband connectivity.

Routers, gateways, and hotspots – Providing portable and enterprise-ready 5G connectivity.

This diverse ecosystem ensures 5G SA adoption across smartphones, industrial IoT, enterprise networking, and home broadband.

Chipsets and Modems: Enabling 5G SA Performance

The ecosystem is supported by 104 announced modems and mobile processors with 5G SA support from six vendors. Of these, 100 are commercially available, including:

15 discrete modems

82 mobile processors and platforms

Additionally, 49 chipsets with 5G carrier aggregation support have been identified, an essential feature for boosting performance and accelerating SA adoption.

Spectrum Support in 5G SA Devices

Device support for sub-6 GHz frequencies continues to expand, aligning with the most widely deployed 5G bands, including:

C-band

2.6 GHz

2 GHz

700 MHz

1.8 GHz

While millimeter-wave (mmWave) support remains limited, only 16 chipsets currently support SA in mmWave spectrum. However, GSA expects mmWave adoption to rise as regulators promote these bands for private 5G networks and high-capacity public deployments.

The rapid growth of 5G SA device availability reflects the industry’s commitment to standalone networks as the foundation of next-generation connectivity. With over 2,400 devices supporting SA and continued advancements in chipsets, spectrum coverage, and form factors, the ecosystem is ready to support widespread adoption in consumer, enterprise, and industrial markets.

As operators expand 5G SA coverage in 2025, the availability of devices across multiple categories ensures that both public networks and private 5G deployments will benefit from faster adoption and improved performance.

Baburajan Kizhakedath