Open RAN (O-RAN) has evolved from hype to a more measured stage of adoption since the O-RAN Alliance was formed in 2018 to drive openness, virtualization, and interoperability in radio access networks (RAN). While early adoption was strong, particularly in Japan and the U.S., the current trajectory reflects both challenges and opportunities for long-term growth.

Open RAN Market Growth Trends

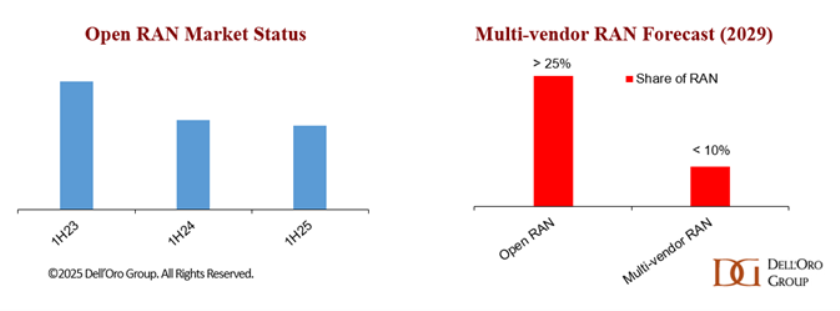

Cumulative Open RAN revenues are nearing $10 billion, a milestone for the ecosystem. After a sharp adoption cycle led by early movers in Japan and the U.S., revenues declined by nearly 40 percent over two years as activity outside these markets slowed.

However, stabilization is now emerging. Preliminary data show Open RAN revenues grew year-over-year in 2Q25 and remained flat in the first half of 2025, supported by capex from ongoing deployments and increasing activity among early majority adopters, Dell’Oro Group’s analyst Stefan Pongratz said in a report.

The five-year forecast (2025–2029) remains positive. Despite near-term cost efficiency and supplier diversity challenges, RAN markets are moving toward openness, virtualization, and AI-driven automation. By 2029, multi-vendor RAN revenues are expected to reach $2–$3 billion, signaling steady, if slower, adoption.

Vendor Landscape and Market Concentration

Despite Open RAN’s mission of vendor diversification, concentration remains high. The latest 1H25 report shows the RAN market is now classified as “highly concentrated” (HHI > 2500) in five of six tracked regions, raising concerns about fading supplier diversity.

In the virtualized RAN (vRAN) segment, the top three vendors by global revenue (2Q25, trailing four quarters) are:

Samsung

Rakuten Symphony

Fujitsu

These suppliers dominate due to strong deployments and regional leadership, with vRAN revenues projected to expand through 2025.

Operator Priorities in Open RAN and Cloud RAN

Leading global operators are positioning Open RAN, Cloud RAN, and AI-driven RAN as central to their next-generation network strategies. The Open Fronthaul (OFH) interface has emerged as a critical requirement for interoperability.

Still, the multi-vendor RAN model — once central to the Open RAN vision — faces limited traction. Integration complexities, performance concerns, and cost challenges are slowing adoption, even as operators continue to explore cloud-native and AI-enhanced RAN architectures.

Global Open RAN Initiatives by Telecom Operators

United States

AT&T is investing $14 billion over five years to shift 70 percent of wireless traffic onto Open RAN platforms by 2026. AT&T is doing multi-vendor deployment with Ericsson, Fujitsu, Dell, Intel, Mavenir, and Corning. Its focus is on automation through Ericsson’s Intelligent Automation Platform and RICs to replace legacy SON systems by 2025.

Japan

Rakuten Mobile is running the world’s first fully virtualized, cloud-native Open RAN network, covering 98 percent of Japan’s population. Its Rakuten Communications Platform (RCP) is now a global reference model.

NTT Docomo is deploying 5G Open RAN sites in Tokyo with NEC, Samsung, Fujitsu, and Nokia. Its OREC ecosystem with 13 vendors supports global interoperability testing.

India

Reliance Jio is scaling Open RAN with vendor-neutral hardware, automation, and AI integration.

Bharti Airtel has deployed Open RAN at 2,500 rural sites, with plans for 10,000 by end-2025. It signed a multi-billion dollar agreement with Ericsson for Open RAN-ready upgrades. Airtel launched a cloud and AI platform via Xtelify, partnering with Singtel, Globe Telecom, and Airtel Africa.

Vodafone Idea (Vi) is conducting advanced Open RAN pilots with Mavenir, including mmWave deployments on cloud-native RAN.

Europe

Vodafone UK: Deployed the first macro 5G Open RAN site using Samsung vRAN, Dell servers, and Wind River cloud.

Vodafone Europe: Targeting 2,500 Open RAN sites by 2027 and 30 percent of sites (~30,000) by 2030.

Deutsche Telekom is partnering with Nokia, Fujitsu, and Mavenir to deploy 3,000+ Open RAN sites in Germany, replacing Huawei equipment.

Other Markets

Telus (Canada): Building Canada’s first commercial vRAN/Open RAN network with Samsung, Wind River, HPE, and Intel.

EchoStar (USA): Opened the ORCID lab in Wyoming for Open RAN testing, with $50M U.S. government funding.

Telefonica (Germany, O2): Deployed the first Cloud RAN/vRAN commercial site in Landsberg using Samsung and Ericsson.

Outlook: Steady Growth Ahead

The Open RAN market is moving into a phase of stabilization and measured growth. While early hype has cooled, vendor innovation, operator investment, and government support ensure long-term momentum. Consolidation at the top will continue, but new entrants may find opportunities in regional deployments, automation, and AI-driven RAN optimization.

Baburajan Kizhakedath