The TV panel manufacturing business has witnessed a resurgence during the first quarter of 2024, with inventories returning to healthy levels, albeit slightly lower than usual.

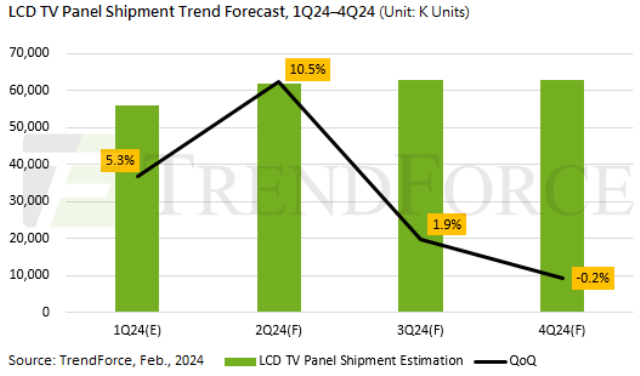

This positive shift was attributed to effective production rate management by panel makers. A notable surge in demand was observed from January onwards, fueled by various factors including anticipations of price hikes, stockpiling activities ahead of shopping festivals and sporting events, alongside logistical disruptions caused by conflicts in the Red Sea. According to TrendForce, shipments of LCD TV panels are estimated to soar to 55.8 million units in the first quarter, marking a substantial 5.3 percent quarter-on-quarter increase.

This positive shift was attributed to effective production rate management by panel makers. A notable surge in demand was observed from January onwards, fueled by various factors including anticipations of price hikes, stockpiling activities ahead of shopping festivals and sporting events, alongside logistical disruptions caused by conflicts in the Red Sea. According to TrendForce, shipments of LCD TV panels are estimated to soar to 55.8 million units in the first quarter, marking a substantial 5.3 percent quarter-on-quarter increase.

The onset of the Lunar New Year prompted panel manufacturers to optimize production costs by scaling back operations during the traditional off-season in February. Consequently, panel materials were concentrated in January and March, propelling a resurgence in prices for medium and small-sized TV panels throughout the first quarter.

Looking ahead to the second quarter, TrendForce anticipates further price increases in TV panels, likely boosting shipments to 61.5 million units, reflecting a significant 10.5 percent quarter-on-quarter surge. This optimistic outlook is underpinned by anticipated demand spikes driven by promotional activities during the 618 Festival in April and May, as well as stockpiling in preparation for the Paris Olympics. However, June might witness a more cautious approach from clients as they await actual sales outcomes, posing a critical juncture for monitoring shifts in TV panel prices.

As the industry progresses into the second half of the year, panel makers face a confluence of challenges amidst a backdrop of slow global economic recovery and heightened geopolitical risks. While the TV panel market has stabilized and turned profitable compared to the IT panel market, uncertainties loom large, particularly regarding the demand peak season. TrendForce reports a 6.7 percent increase in current shipment targets set by panel makers compared to 2023, indicating a continued aggressive shipping stance post-profitability.

Nonetheless, the latter half of 2024 could prove to be a testing period, especially if global demand faces downturns due to volatile geopolitical landscapes. With supply-side dynamics relatively balanced and LG Display’s Guangzhou plant expected to restart operations, any adverse shifts in demand could upset market equilibrium, necessitating a delicate balancing act between volume and pricing strategies for panel manufacturers.

Baburajan Kizhakedath