Emerson announced its deal to buy test and measurement company NI for $60 per share in cash at an equity value of $8.2 billion.

Keysight Technologies was one of the front runners to buy its rival NI. Emerson aims to make investment in higher growth and higher margin automation business. The deal is expected to close in the first half of Emerson’s fiscal 2024.

Keysight Technologies was one of the front runners to buy its rival NI. Emerson aims to make investment in higher growth and higher margin automation business. The deal is expected to close in the first half of Emerson’s fiscal 2024.

Austin, Texas-based National Instruments (NI) provides software-connected automated test and measurement systems that enable enterprises to bring products to market faster and at a lower cost. NI’s solutions help customers solve test challenges and improve speed and efficiency in their product development cycles.

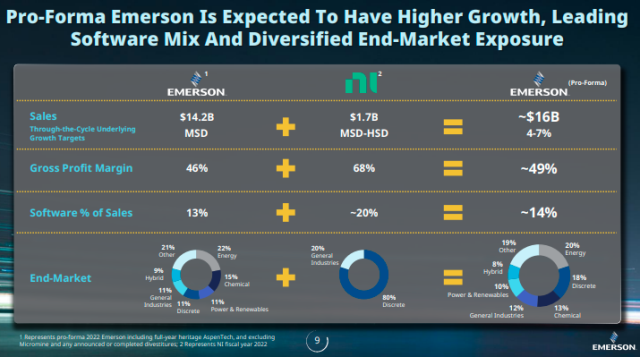

NI had $1.66 billion in 2022 revenue and operates in more than 40 countries, serving approximately 35,000 customers across semiconductor and electronics, transportation, and aerospace and defense markets.

“We reached an agreement with NI, whose best-in-class test and measurement product and software offerings accelerate Emerson’s progress toward a cohesive, higher growth and higher margin automation portfolio,” said Lal Karsanbhai, Chief Executive Officer of Emerson.

“We reached an agreement with NI, whose best-in-class test and measurement product and software offerings accelerate Emerson’s progress toward a cohesive, higher growth and higher margin automation portfolio,” said Lal Karsanbhai, Chief Executive Officer of Emerson.

NI’s capabilities provide Emerson industry diversification into attractive and growing discrete markets like semiconductor and electronics, transportation and electric vehicles, and aerospace and defense that are poised to benefit from secular growth trends.

The transaction is expected to be immediately accretive to EPS and Emerson’s financial targets outlined at Emerson’s 2022 Investor Conference. NI’s positions in attractive and growing markets are expected to deliver sustainable growth aligned to Emerson’s 4-7 percent through-the-cycle underlying growth target.

Emerson, which had first approached National Instruments with an offer of $48 per share last May, beat out rival bidder Fortive in a tightly contested process.

St. Louis, Missouri-based Emerson has executed a string of deals over the last few years to streamline itself into an industrial automation provider.

In 2021, Emerson merged its software units with smaller rival Aspen Technology as part of its industrial automation push.