India 5G subscriptions are forecast to reach over 270 million by the end of 2024, accounting for 23 percent of the total mobile subscriptions in the country.

5G subscriptions in India are expected to reach around 970 million by the end of 2030, accounting for 74 percent of mobile subscriptions, the November 2024 edition of the Ericsson Mobility Report indicated today.

In India, enhanced mobile broadband and FWA have emerged as the initial 5G use cases. 4G continues to be the dominant subscription type, contributing 54 percent of the total mobile subscriptions currently. Leading 5G operators in India are Reliance Jio and Bharti Airtel. Vodafone Idea is planning to offer 5G services.

4G subscriptions in India are forecast to decline from 640 million in 2024 to 240 million in 2030, contributing around 18 percent of the total mobile subscriptions.

India has made large-scale mid-band deployments and is expected to reach around 95 percent population coverage by the end of 2024.

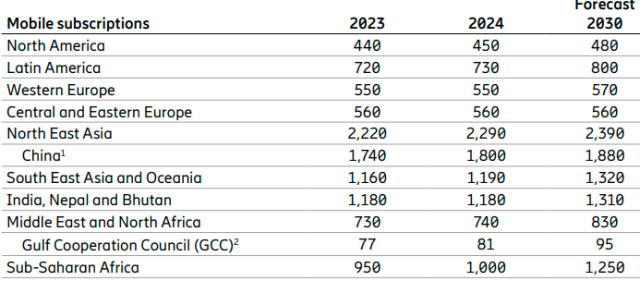

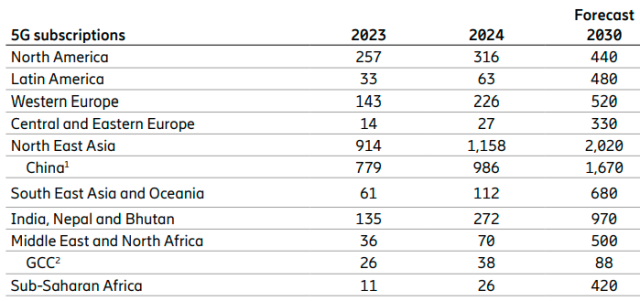

Global 5G subscriptions are expected to reach 2.3 billion by the end of 2024, amounting to 25 percent of all global mobile subscriptions.

At the end of 2024, North America is set to have the highest 5G subscription penetration globally at 71 percent, followed by North East Asia at 51 percent, the GCC countries at 47 percent and Western Europe at 41 percent. 5G subscriptions increased by 163 million during the third quarter to total 2.1 billion.

5G Standalone (5G SA) and 5G Advanced are expected to be key focuses for communications service providers (CSPs) for the remainder of the decade as they deploy new capabilities to create offerings centered on value delivery rather than data volume.

Total mobile network data traffic (including FWA) is expected to grow almost three-fold by the end of 2030 from present day numbers.

Of about 320 CSPs currently offering commercial 5G services, less than 20 percent are 5G SA. 5G mid-band is currently deployed at only about 30 percent of sites globally. Almost 60 percent of the 6.3 billion global 5G subscriptions forecast by the end of 2030 are expected to be 5G Standalone (SA) subscriptions.

In India, average monthly data usage per smartphone is expected to grow to 66GB by 2030 from 32 GB at present.

On global mobile data traffic, 5G networks are expected to carry about 80 percent of total mobile data traffic by the end of 2030 – compared to 34 percent by the end of 2024.

In four out of six regions, more than 80 percent of CSPs offer FWA service. The number of FWA service providers offering speed-based tariff plans – with downlink and uplink data parameters similar to cable or fiber offerings – has increased from 30 percent to 43 percent in the last year alone. Of the 350 million projected global FWA connections by the end of 2030, almost 80 percent are forecast to be over 5G.