Verizon Communications has revealed its business performance for Q2 2024, showing strong wireless service revenue and 5G broadband subscriber growth.

Wireless Segment:

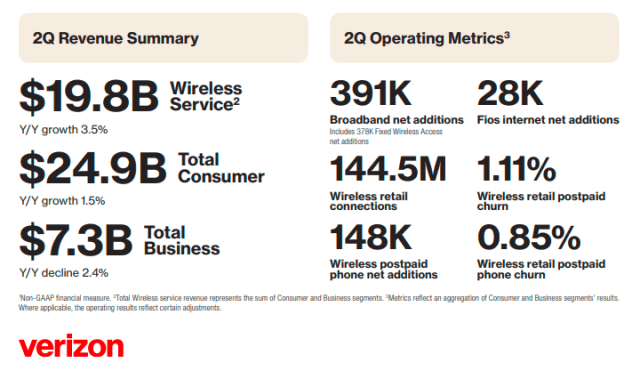

Revenue Growth: Verizon reported total wireless service revenue of $19.8 billion, marking a 3.5 percent increase.

Subscriber Additions: The company added 148,000 retail postpaid phone subscribers and 340,000 retail postpaid net additions.

Broadband Segment:

Subscriber Growth: Verizon experienced double-digit broadband subscriber growth with 391,000 net additions, making it the eighth consecutive quarter with over 375,000 broadband net additions.

Fixed Wireless: The company added 378,000 fixed wireless subscribers, reaching a total base of over 3.8 million, a nearly 69 percent year-over-year increase.

Total Broadband Subscribers: Verizon had 11.5 million total broadband subscribers at the end of Q2 2024, representing a 17.2 percent year-over-year increase.

Revenue: Fixed wireless revenue for Q2 2024 was $514 million, an increase of over $200 million year-over-year.

Financial Performance:

Operating Revenue: Verizon’s total operating revenue for Q2 2024 was $32.8 billion, a 0.6 percent increase from Q2 2023. This growth was driven by an increase in service and other revenue, partially offset by a decrease in wireless equipment revenue due to lower upgrade volumes.

Net Income and EBITDA: The company reported a consolidated net income of $4.7 billion, down from $4.8 billion in Q2 2023. However, consolidated adjusted EBITDA was $12.3 billion, up from $12.0 billion in Q2 2023.

Capital Expenditures: Capital expenditures for the first half of 2024 were $8.1 billion, compared to $10.1 billion in the first half of 2023, indicating a return to historical levels of capital intensity.

Challenges:

Wireless churn rates: Retail postpaid phone churn was 0.85 percent, while retail postpaid churn stood at 1.11 percent.

Churn Rates: Consumer wireless retail postpaid churn was 1.00 percent in Q2 2024, with wireless retail postpaid phone churn at 0.79 percent. Business wireless retail postpaid churn was 1.45 percent, with wireless retail postpaid phone churn at 1.10 percent.

Net Losses: The Consumer segment reported 8,000 wireless retail postpaid phone net losses, an improvement from the 136,000 net losses in Q2 2023.

Verizon’s strong performance in wireless service revenue and broadband subscriber growth highlights its strategic focus on expanding its customer base and enhancing service offerings, despite facing some challenges in churn rates and net losses in certain segments.