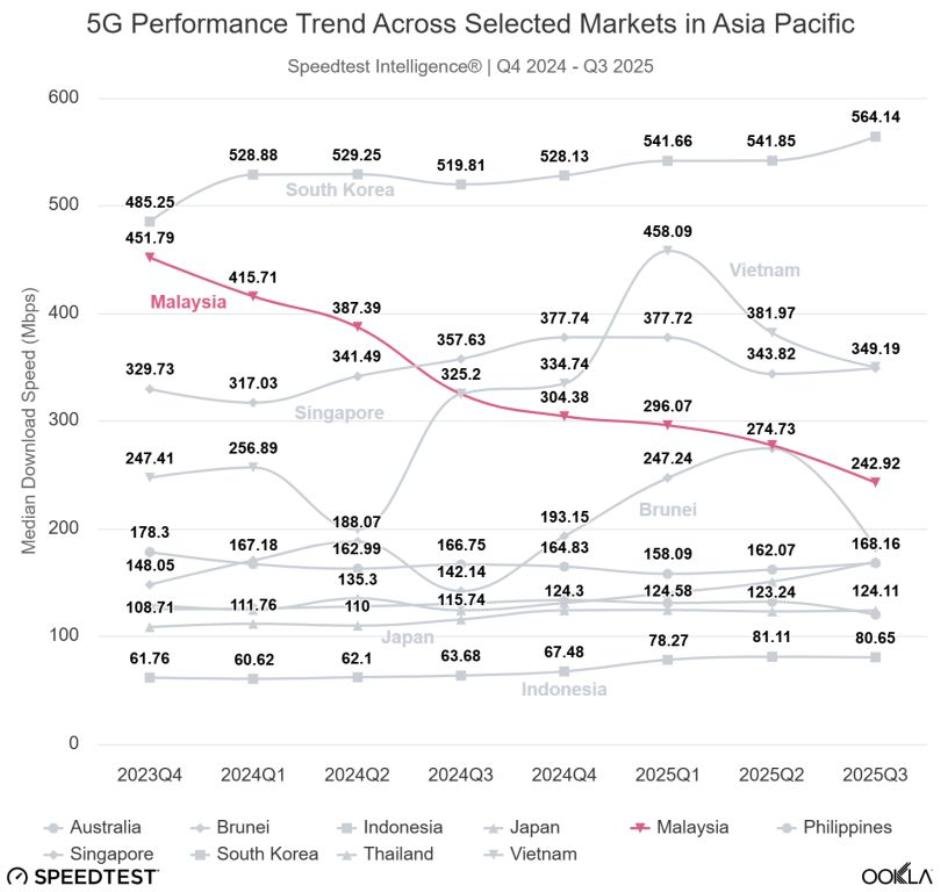

Malaysia’s 5G network performance has declined steadily from Q4 2023 to Q3 2025, signaling a clear shift from its earlier position as one of the fastest 5G markets globally. After ranking third worldwide in Q3 2023, Malaysia’s median 5G download speed dropped sharply from 451.79 Mbps in Q4 2023 to 242.92 Mbps in Q3 2025. Over the same period, median 5G upload speeds fell from 49.87 Mbps to 29.52 Mbps, according to an Ookla report.

The slowdown coincided with Malaysia’s unique Multi-Operator Core Network model operated by government-owned Digital Nasional Berhad (DNB). While the model enabled rapid nationwide rollout and fast initial speeds, wider coverage expansion, rising subscriber adoption, and growing demand for high-capacity applications have placed increasing strain on shared network resources. As deployment moved beyond dense urban centers into broader geographic areas, congestion and spectrum limitations became more pronounced, Affandy Johan, Industry Analyst at Ookla Research, said.

In contrast, regional peers such as South Korea and Singapore maintained stable or improving 5G performance over the same period, while newer 5G markets including Vietnam and Brunei recorded strong speed gains due to lower early-stage congestion and smaller subscriber bases. Despite the decline, Malaysia’s 5G performance in Q3 2025 remains competitive within Southeast Asia, outperforming markets such as the Philippines, Japan, and Thailand, underscoring that Malaysia is still a relatively strong 5G performer even as network maturity challenges emerge.

At the same time, 5G adoption in Malaysia is accelerating rapidly. GSMA Intelligence data shows that 5G now accounts for almost 40 percent of total consumer mobile connections, while 4G represents close to 60 percent. Speedtest Intelligence data highlights a sharp rise in 5G-capable device penetration between Q4 2023 and Q3 2025, reflecting growing consumer readiness for next-generation mobile services.

In Q3 2025, 79.5 percent of all Speedtests in Malaysia were conducted on 5G-capable devices. Of this total, 55.0 percent of tests were carried out on active 5G connections, while 24.5 percent came from 5G-capable devices using non-5G networks. This marks a significant increase from Q4 2023, when 5G-capable devices accounted for 58.6 percent of tests and only 35.4 percent were connected to 5G. The data clearly indicates that Malaysia’s 5G subscriber base is expanding quickly, driven by higher smartphone compatibility, improved network availability, and stronger operator offerings.

However, despite the surge in 5G-capable devices, most users still spend the majority of their connected time on 4G networks. Q3 2025 data shows that 65.8 percent of total connected time for 5G-capable devices remains on 4G, compared with just 29.8 percent on 5G. This gap highlights the difference between device readiness and real-world 5G usage.

The heavy reliance on 4G is largely due to limited nationwide 5G indoor coverage and uneven availability outside major urban areas. High-frequency 5G spectrum delivers faster speeds but struggles with indoor penetration, even though an estimated 70 percent to 80 percent of mobile usage occurs indoors. To address this, Digital Nasional Berhad has been rolling out 5G In-Building Solutions at high-traffic locations. As of January 2025, 73 strategic sites, including airports, hospitals, and transport hubs, were equipped with 5G IBS.

In addition, while Malaysia has surpassed its 80 percent coverage of populated areas target, reaching about 82.4 percent, 5G connectivity in rural and non-urban regions remains inconsistent. Deployment in many states is still concentrated in capital cities and major towns, forcing devices to fall back on 4G outside these hubs. These factors together explain why 4G continues to dominate user connectivity time, even as 5G adoption accelerates.

CelcomDigi remains the largest mobile operator in Malaysia, with around 18.36 million combined mobile subscribers as of Q3 2025.

Maxis holds the second-largest share of mobile subscribers in Malaysia, with approximately 13.24 million mobile subscriptions reported in Q1 2025. U Mobile and YES (YTL Communications) are the third and fourth largest telecom operators in Malaysia.

Malaysia is now entering a pivotal phase in its 5G evolution as it transitions from the government-led single wholesale network model to a Dual Network approach aimed at introducing competition. The shift was triggered after DNB met its mandated coverage target by the end of December 2023. In November 2024, the government selected U Mobile to deploy the country’s second 5G network, marking a move away from a monopoly structure toward a more competitive 5G landscape.

U Mobile began rolling out 5G services using standalone access technology in March 2025 and aims to achieve 80 percent coverage of populated areas within its first year and 95 percent by the third year. During this transition, DNB continues to operate and expand its existing network in parallel. The move presents complex challenges, including spectrum allocation between two networks, ensuring DNB’s financial sustainability, and efficiently managing parallel nationwide 5G infrastructures.

Controlled network testing conducted by Ookla using Speedtest Drive in October 2025 shows that DNB’s established network currently delivers the most extensive and reliable 5G footprint in Malaysia. DNB retained its original F1 spectrum across the 700 MHz, 3.5 GHz, and 28 GHz bands, while U Mobile received F2 spectrum blocks in the 700 MHz and 3.5 GHz bands for its rollout. Testing across key Klang Valley locations revealed that U Mobile subscribers relied heavily on DNB’s infrastructure, with 83.2 percent of test samples camping on DNB-managed frequencies, including 67.9 percent on the critical mid-band 3500 MHz spectrum. By comparison, U Mobile’s own network accounted for just 16.8 percent of samples despite active deployment.

The findings confirm that DNB’s mature mid-band 5G infrastructure remains the backbone of Malaysia’s 5G experience, even as competition begins to take shape. As U Mobile accelerates its standalone 5G rollout, the Dual Network model is expected to drive the next phase of innovation, service differentiation, and competitive dynamics in Malaysia’s 5G market, while keeping DNB as the anchor network during the transition.

Baburajan Kizhakedath