T-Mobile US delivered strong Q4 and full-year 2025 results, highlighting record customer growth, rising service revenue and a clear strategy focused on 5G leadership, AI-driven networks and broadband expansion. The Un-carrier also shared a disciplined capital outlook for 2026 as its aggressive 5G investment cycle begins to stabilize.

Revenue and profitability beat expectations

T-Mobile reported Q4 revenue of $24.33 billion, rising 11.2 percent year over year. The performance was fueled primarily by strong service revenue growth and premium plan adoption.

Service revenue reached $18.7 billion in the quarter, up 10.5 percent year over year, marking one of the fastest growth rates in the U.S. telecom industry.

Net income totaled $2.11 billion, with earnings per share of $1.88. EPS fell slightly short of forecasts due to higher integration and marketing expenses tied to ongoing strategic initiatives.

Record subscriber growth strengthens market position

T-Mobile continued to lead the U.S. wireless industry in customer growth.

Postpaid net customer additions: 2.4 million in Q4

Full-year postpaid net additions: 7.8 million

Total customers: 142.4 million

The company added 962,000 postpaid phone customers in Q4, the highest among the major U.S. carriers amid intense holiday promotions from rivals.

Postpaid ARPA surpassed $150, rising 3 percent year over year, while postpaid phone ARPU remained stable at approximately $50.71 as customers continued migrating to premium Go5G plans. Premium plan adoption reached a 60 percent take rate among new customer accounts.

T-Mobile’s postpaid churn rate stood at 1.02 percent, slightly higher than 0.92 percent a year earlier, reflecting heightened competitive activity in the market.

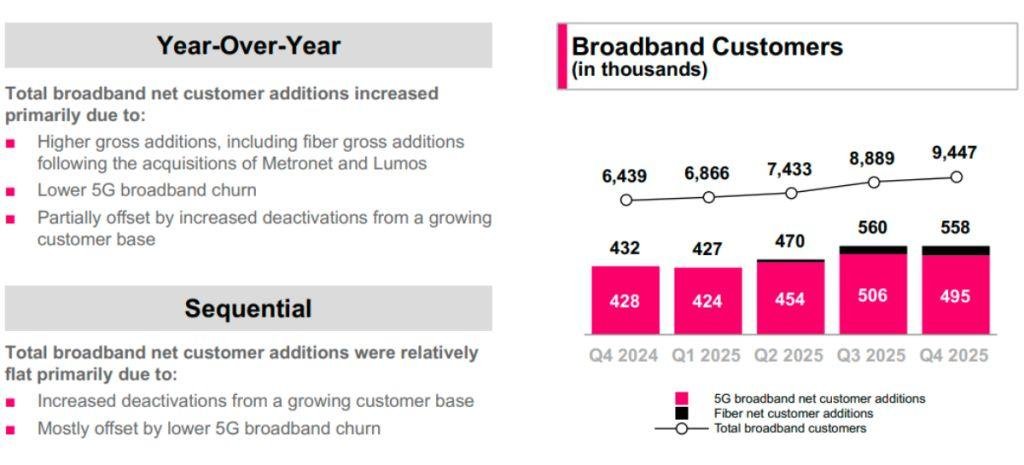

Broadband and fiber drive “Beyond the Smartphone” strategy

T-Mobile’s expansion into home internet and fiber continues to deliver significant growth.

Total broadband customers reached 9.5 million, including 558,000 net additions in Q4 alone.

Fixed wireless access momentum

T-Mobile now serves 8.5 million 5G High-Speed Internet customers. The company remains on track to reach its target of 12 million fixed wireless subscribers by 2028.

Fiber expansion accelerates

Fiber growth is gaining traction through joint ventures and acquisitions:

63,000 fiber customers added in Q4

Nearly 1 million fiber subscribers total

Target to reach 12 to 15 million households by 2028

This multi-network strategy positions T-Mobile as a stronger competitor in the U.S. broadband market.

AI and network leadership as key differentiators

T-Mobile is investing heavily in AI to widen its competitive advantage.

The company is embedding real-time AI into its network through the T-Platform and Edge Control systems. These technologies aim to improve network performance, automate operations and enhance customer service.

T-Mobile continues leveraging its mid-band 5G leadership to capture value-focused customers and expand coverage in rural markets.

Competitive pressure impacts subscriber expectations

Despite strong growth, T-Mobile faced aggressive promotions from rivals during the holiday season. Verizon recorded its strongest quarterly wireless subscriber growth in six years through device-heavy promotions.

T-Mobile still led the industry in postpaid phone additions, though the figure came slightly below analyst expectations. Shares dipped about 3.4 percent in premarket trading following the results.

2026 outlook focuses on efficiency and cash flow

T-Mobile expects a more disciplined spending environment in 2026.

Capex guidance: about $10 billion as 5G buildout stabilizes

Synergies from UScellular integration: $1.2 billion annually

Expected Opex reductions: about $950 million

The company projected adjusted free cash flow between $18 billion and $18.70 billion for 2026, slightly below analyst expectations due to integration costs.

Strong foundation for long-term growth

T-Mobile enters 2026 with strong momentum driven by subscriber growth, expanding broadband and fiber services and increasing AI integration. With capital spending stabilizing and synergies improving profitability, the company is positioning itself for sustainable long-term growth in wireless and home connectivity markets.

BABURAJAN KIZHAKEDATH