5G infrastructure spending in the Middle East & North Africa (MENA) region will not be encouraging for 5G-driven telecom network makers, a GSMA report indicates.

Batelco, Etisalat, MTN, Omantel, Ooredoo, Turkcell, Turk Telekom, Vodafone, Orange, Airtel and Zain are some of the leading telecom operators in MENA region.

Batelco, Etisalat, MTN, Omantel, Ooredoo, Turkcell, Turk Telekom, Vodafone, Orange, Airtel and Zain are some of the leading telecom operators in MENA region.

Telecom equipment makers such as Huawei, Ericsson, Nokia, ZTE and Samsung are betting on 5G boom to improve their financial conditions.

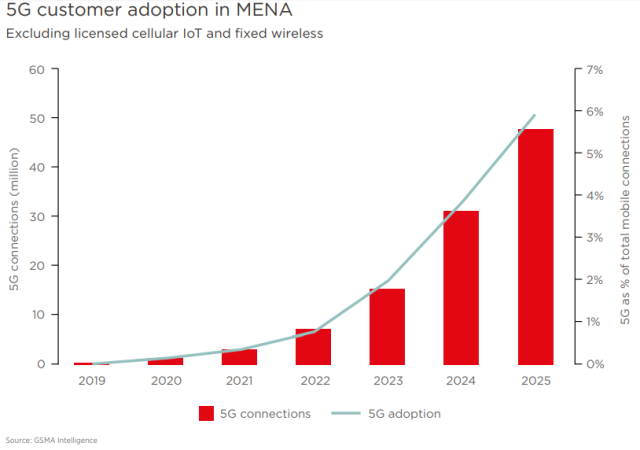

The number of 5G mobile connections in the MENA region will grow slowly in the first two or three years. There will be around 50 million 5G connections, with about 20 million in the GCC Arab States, in 2025, GSMA Intelligence said.

The GCC Arab States will be slightly ahead of the global average by 2025, with 16 percent adoption (5G as a percentage of total mobile connections), compared to 15 percent globally, GSMA said.

The GCC Arab States will be slightly ahead of the global average by 2025, with 16 percent adoption (5G as a percentage of total mobile connections), compared to 15 percent globally, GSMA said.

15 countries plan to launch 5G mobile services in the MENA region between 2019 and 2025. Six MENA countries launched 4G commercial services during 2009-2011 compared to eight countries launching 5G during 2019-2021.

GSMA said 5G will involve slower network rollout, smaller population coverage and slower customer adoption because mobile operators are still looking for 4G for connections growth and routes to monetisation.

GSMA said 5G will involve slower network rollout, smaller population coverage and slower customer adoption because mobile operators are still looking for 4G for connections growth and routes to monetisation.

Launch of 5G mobile services in the GCC Arab States will begin in 2019, when the first 5G smartphones will be commercially available.

15 MENA countries plan to launch 5G mobile services by 2025 – these account for more than half the markets in the region.

15 MENA countries plan to launch 5G mobile services by 2025 – these account for more than half the markets in the region.

5G Capex

Much of the 5G Capex will be come between 2020 and 2025 as 5G customer adoption grows and demand for enterprise use cases builds.

Most mobile operators are planning nonstandalone (NSA) network architecture. Mobile operators aim to use existing macro sites and LTE spectrum as an anchor connection, with a densified network of small cells and use of mid-band (1-6 GHz range) and upper-band (above 6 GHz) spectrum to facilitate data services.

Some MENA operators will launch standalone (SA) networks – which involve the use of a 5G core and new radio – in key locations to leverage the capability of low-latency features. Some mobile operators will be looking at NSA or hybrid configuration as a long-term solution.

Etisalat, Ooredoo, STC and Zain launched 5G in UAE, Qatar, Saudi Arabia and Kuwait, respectively.

Etisalat, Ooredoo, STC and Zain launched 5G in UAE, Qatar, Saudi Arabia and Kuwait, respectively.

Ooredoo has installed over 85 5G network towers in Doha’s most populated areas. But the service is not ready for both consumers and businesses.

Most 5G trials in the MENA region are using frequency bands in the 1-6 GHz range. Globally, a large number of 5G trials are being conducted using a balanced mix of 1-6 GHz and above 6 GHz frequency ranges.

More than 130 operators have trialled, or are trialling, 5G technology across nearly 70 countries. 3.5 GHz and 26/28 GHz have attracted the most attention so far around the globe.

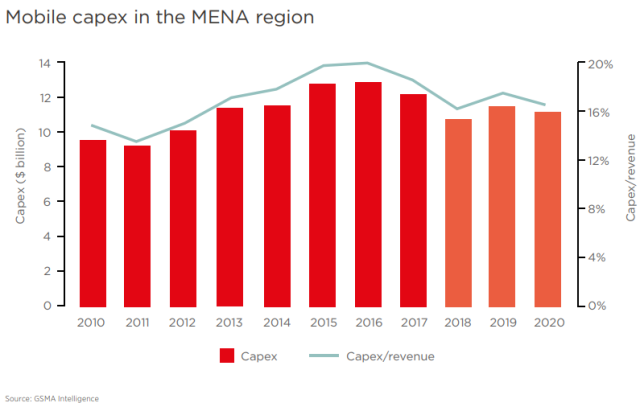

Operators in the MENA region have invested nearly $90 billion so far this decade in mobile Capex, keeping 17 percent of mobile revenue on average per year, on spending.

Mobile operators in the MENA region will invest $34 billion towards Capex between 2018 and 2020.

Much of the 5G Capex will likely come between 2020 and 2025 as consumer demand for 5G connectivity and services grows and enterprise use cases develop.

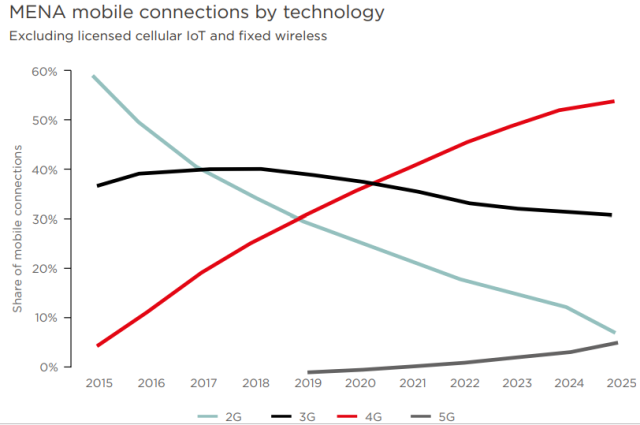

5G will also add pressure to phase out previous generation networks, particularly in markets where 5G network rollout and customer adoption progress quickly. The timeline for such phasing out and the network most likely to be phased out (2G or 3G) are uncertain at this stage.

The speed of migration of voice services to VoLTE and, eventually, 5G new radio is also a key factor. In some MENA markets, 3G will likely be phased out earlier than 2G.

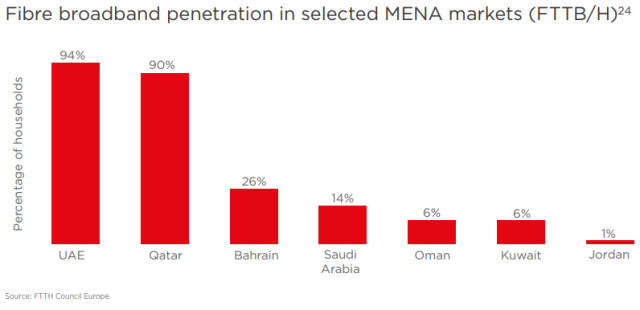

5G-based fixed wireless will be an early use case for 5G around the GCC Arab States, with several operators, including Etisalat, Ooredoo, STC and Zain, launching services between 2018 and 2020.

Countries in other parts of MENA, including Turkey, will witness the commercialisation of 5G-based fixed wireless.

Nine of the 25 markets in MENA will have 4G adoption of at least 30 percent, with Turkey leading the way at 75 percent — by the end of 2018.

4G will overtake 3G by number of mobile connections during 2021 and will account for half of total connections by 2024. 4G will also account for the largest portion of operators’ revenue for the next decade.

There are 381 million unique mobile subscribers across the MENA region, accounting for 64 percent of the population.

The number of smartphone connections across MENA stands at 332 million as of Q2 2018, accounting for over 50 percent of total connections in the region and will reach 587 million smartphones connections by 2025.