The latest financial results from telecom operators worldwide reveal a decline in capital expenditure (capex) in 2023, with further decreases projected for 2024.

This trend aligns with Analysys Mason’s recent telecoms capex forecasts. This analysis delves into capex changes across various regions, highlighting the implications for vendors and civil engineering firms, while exploring the strategic options available to operators due to improved cash flow.

2023 Capex Decline and Regional Variations

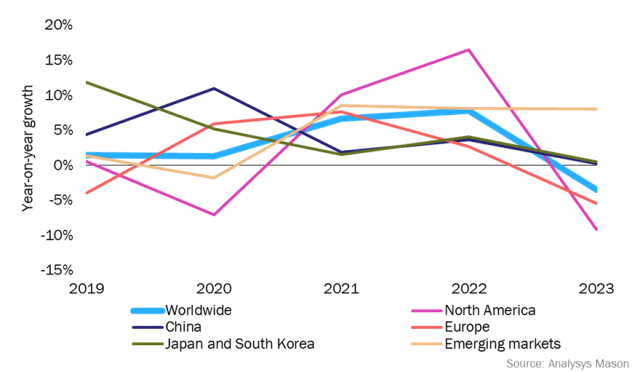

The above chart aggregates the changes in capex, excluding spectrum, for 50 of the world’s largest telecom operators, each with annual capex exceeding USD 1 billion. These operators represent approximately 78 percent of global telecom capex.

Capex among these major players decreased by 3.5 percent in 2023, following a 7.8 percent increase in 2022, driven by inflationary pressures.

North America experienced the steepest decline, particularly among the three largest mobile network operators (MNOs), which saw an 18.1 percent drop. However, increased capex by two large US cable companies, driven by imperative HFC plant upgrades, partially offset this decline. The near-completion of 5G roll-outs is a primary factor, although FTTP capex remained stable.

AT&T’s capital expenditures in 2023 were $23.595 billion, indicating that it spent $728 million less than the prior year.

In 2024, AT&T expects that capital investment, which includes capital expenditures and cash paid for vendor financing, will be $21 billion – $22 billion. This shows AT&T’s Capex will be lowered again against its spending in 2023 and 2022.

Verizon Communications has also lowered its capital expenditure to $18.767 billion in 2023 as compared with $23.087 billion in 2022.

In 2024, Verizon is targeting Capex of $17 billion – $17.5 billion.

China’s capex remained flat overall, despite a 7 percent decline in combined 5G and fixed broadband investments. Instead, spending has shifted towards ‘computility’ (compute power in data centers and edge) and capabilities, now accounting for about 35 percent of operator capex.

In 2023, Capex of China Mobile totaled RMB180.3 billion, representing 20.9 percent of services revenue, down by 1.9 percentage points year-on-year. In 2024, China Mobile’s Capex will be around RMB173 billion, down by 4 percent.

Japan and South Korea also saw minimal change in capex (+0.5 percent), with a significant portion of investments directed towards adjacent business lines.

Capex of NTT Docomo, the leading telecom operator in Japan, reached 705.4 billion yen in 2023 vs 706.3 billion yen in 2022. NTT Docomo is targeting to spend 749 billion yen in networks in 2024.

Europe witnessed a 5.5 percent decline in capex, with significant variation across countries. While 5G and FTTP spending has peaked, FTTP still represents a substantial portion of capex, particularly in countries like France and Spain.

European telecom giant Telefonica is aiming for Capex-to-revenue ratio is aiming for Capex-to-revenue ratio of up to 13 percent in 2024. Telefonica is targeting sales growth of just 1 percent in 2024.

Emerging Markets saw an 8 percent increase in capex, driven primarily by India, offsetting declines in other regions.

Capex of Airtel India, the second largest telecom operator, has reached Rs 8,491 crore for the January-March quarter of 2024.

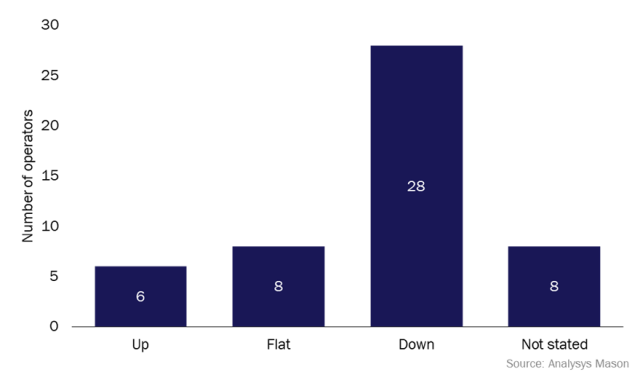

The below chart presents the capex guidance for the next financial year from the same 50 operators.

Out of 42 operators providing 2024 capex guidance, 28 forecast a decline. Exceptions include cable operators and latecomers to FTTP upgrades, though most emerging-market operators anticipate reduced spending.

Long-Term Capex Outlook and Strategic Implications

Operators’ long-term capex projections suggest further declines. Forecasts indicate that capital intensity (capex/revenue) will drop from around 20 percent to 12–14 percent by the end of the decade. This is due to decreasing demand for more than the 1Gbit/s fiber and unlimited 5G currently offered by existing networks.

Key factors include:

Reduced Fixed Access Spend: FTTP investments are essentially one-off, with future upgrades costing significantly less.

Limited 5G SA/5G Advanced Uptake: Due to lack of demand and lower costs compared to 5G NSA roll-outs.

Minimal 6G Investment: Free-market economies show little interest in another capex-intensive generational upgrade.

Increased Outsourcing: Replacing capex with opex, particularly in infrastructure and IT operations migrated to the cloud.

Improved cash flow from reduced capex offers operators strategic flexibility:

Horizontal Consolidation: Investing in scale, potentially through acquisitions at the international service layer.

Infrastructure Investments: Buying back unique carved-out assets or investing in new, higher-quality productive forces outside traditional boundaries.

Adjacent Infrastructure Investments: Exploring opportunities in green power distribution, electric vehicle grids, and broader digital infrastructure, as seen in Chinese and Japanese markets.

Telecom operators foresee clear cash flow improvements from capex reductions, opex efficiencies, and slower depreciation, potentially leading to strategic investments and expansion opportunities in the evolving telecom landscape.

Baburajan Kizhakedath