Leading telecom operators in Malaysia such as Maxis, CelcomDigi and Telekom Malaysia are saying they are making significant investment in mobile network to enhance customer experience.

But TelecomLead.com research shows that Maxis, CelcomDigi and Telekom Malaysia need to step up their Capex related investment in network.

Maxis

Maxis has made an investment of RM106 million during the first quarter of 2024 into network capacity expansion, fibre rollouts and IT digitalisation. This disciplined approach is part of Maxis’ Capex related commitment to support Malaysia Government’s decision on the 5G delivery model by building another 5G network.

Maxis has showcased first 5G-Advanced (5.5G) technology trial in Southeast Asia, offering up to 10 times faster, connects 10 times more devices, and 5 times more responsive than 5G.

Maxis has enriched Hotlink Prepaid and Postpaid plans, offering 5G across the board, even more data, and uncapped speeds.

Maxis introduced all-new 5G Home WiFi plans offering fibre-like speeds through a worry-free plug-and-play experience in Malaysia.

“Enhancing customer experience and delivering better value are our utmost priority. With focused investments in our network and digitalisation, we are confident that we will continue to meet the connectivity needs of our customers,” Goh Seow Eng, CEO of Maxis, said.

CelcomDigi

CelcomDigi has invested RM1,010 million in capital expenditure in Q4 2023, bringing total Capex to RM1. 75 billion, translating into a capex intensity of 13.8 percent in FY2023. CelcomDigi has managed to optimise Capex efficiencies while pushing ahead on prioritised network and IT integration initiatives.

CelcomDigi’s average data per user for Digi customers reached 26.1 GB, up 6.5 percent, while Celcom customers registered 31.2 GB usage monthly, up 11.8 percent.

CelcomDigi’s CEO Datuk Idham Nawawi said, “In 2023, we made significant progress integrating many business areas, achieving this with minimal disruption to customer experience while competing effectively to lead in the market.”

Telekom Malaysia

Capital expenditure of Telekom Malaysia stood at RM204 million, or 7.2 percent of its revenue, aimed at expanding the network infrastructure and regional submarine cable systems.

In February, TM One launched the Innovation Lab and Enterprise 5G Lab to accelerate the realisation of emerging digital services and solutions. Telekom Malaysia made specific investment in these facilities to develop key areas like Enterprise 5G and innovative AI-powered industry solutions.

Amar Huzaimi Md Deris, TM’s Group Chief Executive Officer said: “We will continue enhancing our retail convergence offerings and value-added solutions in delivering improved customer experience. We will maintain a strong focus on modernising our data and network infrastructure, as well as enhancing our business-related offerings to meet digital needs.”

Is Capex enough?

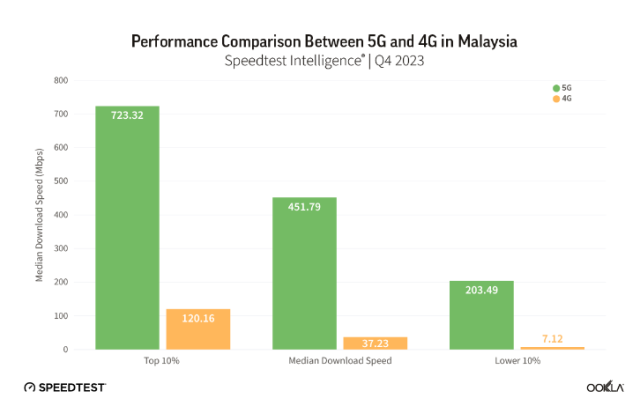

The latest Ookla report says 5G users are experiencing slow download speeds. But they have 5G speeds at least five times faster than the 4G download speed. Speedtest Intelligence data indicates that 5G speeds reached 203.49 Mbps as against 4G download speed of 37.23 Mbps.

5G availability in Malaysia increased from 21 percent to 27 percent in Q4 of 2023 thanks to investment in mobile network from telecom operators.

Malaysia is lagging behind its neighboring countries, such as Singapore and Thailand, which have 53.8 percent and 45.5 percent 5G availability, respectively. Malaysia is only slightly higher than the Philippines, at 26.2 percent. This shows Maxis, CelcomDigi and Telekom Malaysia need to step up their investment in network.

Baburajan Kizhakedath